The 2025 holiday season arrives at a moment of tension in US retail. On one hand, inflationary pressures, tariffs, and consumer fatigue are capping discretionary growth. On the other hand, digital adoption, AI-driven discovery, and mobile commerce are growing at a record pace.

According to eMarketer, total US holiday retail sales are projected to grow just 1.2% YoY in 2025. That’s the slowest increase in over a decade. Yet, this modest headline masks significant shifts in channels.

Beneath it, consumer behavior is shifting in profound ways. Mobile will dominate, AI will guide decisions, resale will enter gifting culture, and shoppers will balance price with quality more carefully than ever.

The year’s most competitive quarter is already making its way. Only if your brand evolves with the upcoming holiday shopping trends in 2025 will you win, or let’s say you’ll have it holi-yay!

What Does the Holiday Season Forecast in 2025 Say?

Three forces shape the market outlook for holiday shopping in 2025:

- Tariffs & economic caution: McKinsey’s consumer research shows trade-down behavior across income groups with the impact of tariff-driven inflation. Even affluent households are choosing value retailers, particularly for lower-priority categories. Halloween candy sales, for instance, are seeing heavier competition from dollar stores and club packs, signaling budget-conscious behaviors in festive categories.

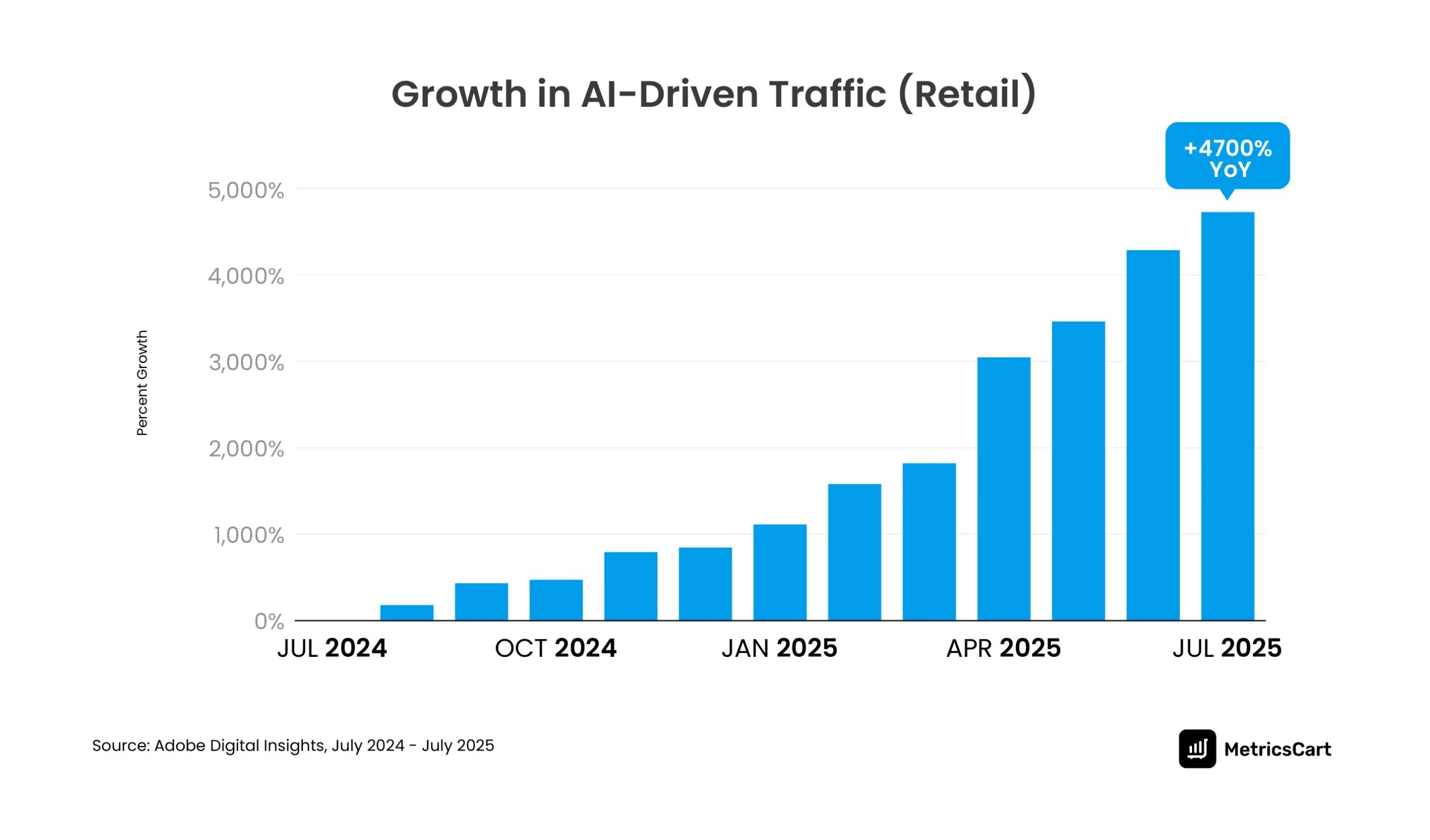

- Technology acceleration: Adobe found 38% of consumers used AI tools for holiday planning in 2024, and generative AI traffic saw a 4,700% YoY rise in July 2025. Consumer search journeys have shifted massively, and they’re actively finding products via AI and voice search and even using it to compare discounts and deals online.

- Calendar shifts: Basis research highlights how many shoppers are now finished before Cyber Week. Last year, 8% of shoppers started as early as September. October increasingly serves as the “kickoff to holiday shopping”, with retailers like Walmart and Target pulling forward promotions in October to secure wallets early. Strategically, this means brands can no longer rely on Black Friday/Cyber Monday spikes alone. The season is longer, fragmented, and powered by diversified discovery.

READ MORE | Want to know sure-shot strategies for the holiday season? Check out Q4 Marketing Strategy to Drive Brand Sales: The Essential List

Top 10 Holiday Shopping Trends in 2025

Based on holiday consumer trends from previous seasons and survey reports, here are the top 10 holiday season highlights you need to prepare for:

1. Category-Specific, Budget-Conscious Spending

PwC’s Holiday Outlook survey predicted that consumers will be spending 5% less on average this season, but they aren’t pulling back uniformly. They’re reallocating budgets by category. Electronics, toys, and appliances remain high on gift lists, especially during Black Friday electronics doorbusters, but discretionary apparel or mid-priced accessories may be deprioritized.

Reports suggest that while Gen Z plans to slash their holiday budgets, boomers are the only generation predicted to increase their average spending by 5%.

Deloitte found that consumers now expect 25% to 40% discounts in order to convert. For brands, the key is surgical promotions: defend margins in stable categories but go aggressive where competition peaks, such as Black Friday electronics or Cyber Monday tech deals.

2. Surge in Early Shopping

Shoppers are front-loading their holiday budgets. Salsify reports 26% of shoppers begin in September or October, with only 9% waiting until December.

For many, Halloween shopping now doubles as early gifting; parents buy toys or décor bundles in bulk. By the time Black Friday hits, many shoppers have already secured big-ticket gifts.

That doesn’t mean Cyber Monday is irrelevant; it has become the “finishing touch” sale where consumers hunt for missed items. Brands should treat October as the new Q4 launchpad, with loyalty-first activations and gift guides live by Halloween.

3. AI Tech (Chatbots & Gift Guides)

AI adoption is a surging one among holiday consumer trends in 2025. Adobe data shows 52% of shoppers plan to use AI this year, with millennials and Gen Z leading the way.

AI-powered assistants are already being deployed to compare Black Friday deals across retailers and to create personalized gift lists before Cyber Monday. In 2024, Cyber Monday saw the biggest spike in chatbot usage.

For retailers and brands, embedding AI-driven personalization and gift guides into websites and PDPs is like providing customized solutions to drive quicker conversions. For example, a chatbot that recommends “best Black Friday bundle deals under $100” is a way to keep shoppers engaged and reduce bounce rates.

READ MORE | AI is indispensable this holiday season! Check out Predicting Purchase Intent: How AI In E-Commerce Drives Conversions.

4. Personal Values & Quality > Price

While discounts dominate headlines, consumers are not only chasing the lowest number. Simon-Kucher reports that shoppers want authenticity, sustainability, and product quality to justify purchases. Shoppers, especially Gen Z, are increasingly leaning towards brands that align with their personal values.

For example, Halloween costume shoppers are shifting toward eco-friendly or reusable costumes, even if they cost more. Likewise, Black Friday shoppers are often willing to pay for trusted brands rather than risk unknown sellers, especially in categories like kids’ toys or electronics. Brands should highlight durability, ethical sourcing, and certifications to win consumers who care about value in more than one dimension.

This is a great opportunity for private labels and challenger brands to grow by winning consumer trust by highlighting value-added offers and innovation.

5. Mobile Commerce Is at the Forefront

Adobe’s holiday shopping insights from 2024 found that 54.5% of holiday ecommerce sales came from smartphones, and in 2025, mobile will drive remarkable incremental growth. Black Friday is now as much a “tap-to-buy” event on smartphones as it is a midnight in-store rush.

Cyber Monday, too, is increasingly mobile-driven, with shoppers scrolling for flash deals during work breaks. For brands, every second counts. Slow mobile checkout is a lost conversion. Investing in app-exclusive deals, wallet integration, and frictionless one-page checkout should be priorities.

6. Influencer Recommendations & Social Commerce

Social platforms have become powerful entry points for holiday discovery. Basis reports that 18% of US consumers are planning to purchase directly through social commerce for holiday shopping in 2025.

TikTok creators are already curating “Best Halloween finds at Target” videos that double as early gift guides. Basis research shows Gen Z and millennials are more likely than average to buy based on social recommendations, and Cyber Monday often sees spikes in influencer-driven flash deal content.

For brands, partnering with creators to amplify retail media campaigns will ensure that products are surfaced during peak digital shopping moments.

7. Re-Commerce on the Rise

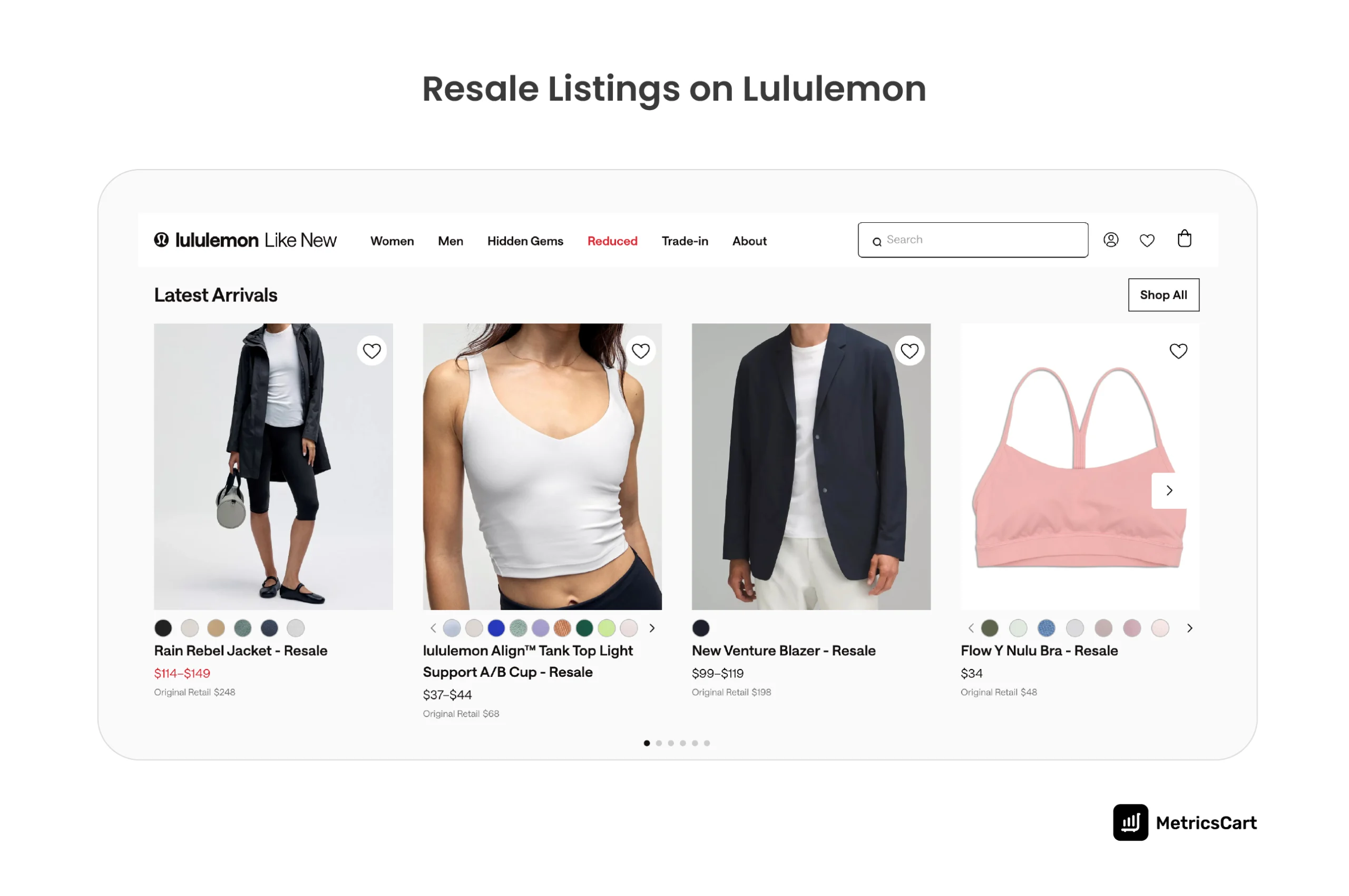

The cultural shift toward resale is undeniable. eBay’s 2025 Re-Commerce Report notes that 86% of consumers bought or sold pre-loved items in the past year. And, 64% consumers believe that pre-loved is better for the planet, signaling massive consumer appetite and a durable circular economy trend.

Halloween is already seeing this in secondhand costume marketplaces, and an increasing shift towards thrifting, while Black Friday is increasingly tied to certified refurbished electronics.

For brands, this isn’t a threat but an opportunity to penetrate the pre-loved segment. Offering refurbished or trade-in programs keeps budget-conscious shoppers and sustainability-minded buyers inside your ecosystem.

8. Hybrid, Cross-Channel Shopping (BOPIS)

When deadlines loom, omnichannel wins. Adobe notes that BOPIS orders doubled in the last two weeks before Christmas, peaking on December 23 in 2020. Black Friday often drives foot traffic to stores, but increasingly, shoppers are reserving items online and collecting them in-store to secure availability.

BOPIS usually peaks because of last-minute shopping needs or when the delivery estimate doesn’t match the shopper’s required timeline.

Halloween décor buyers already rely on BOPIS to avoid stock-outs. For brands, this means real-time inventory accuracy and clear ship-by cutoffs are not optional. A bad pickup experience is an instant loyalty killer.

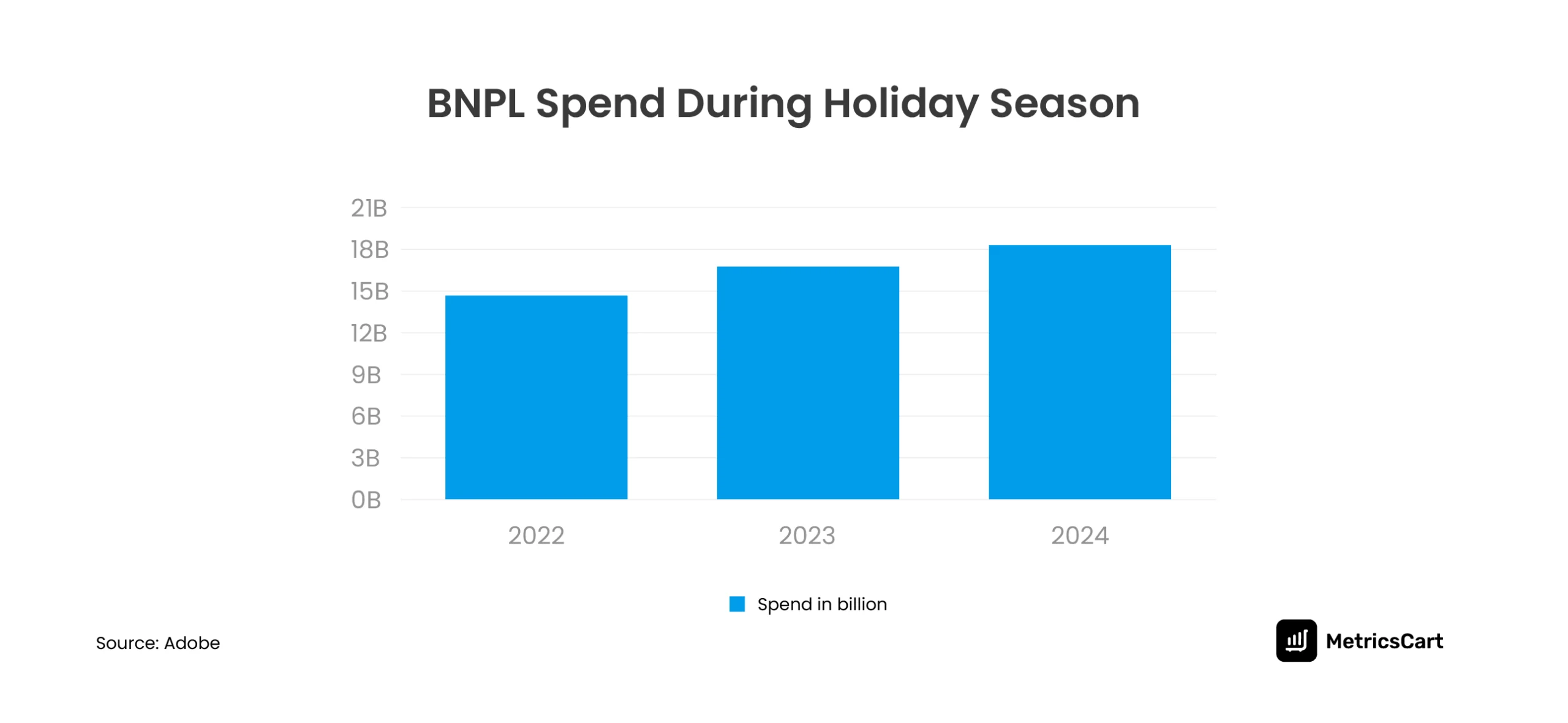

9. Flexible Payment Options (BNPL)

Going by the holiday consumer trends in the last few years, BNPL has become a mainstream financial tool. Data shows it fueled $18.2 billion in holiday sales in 2024, including nearly $1 billion on Cyber Monday.

For many households, it’s the only way to stretch budgets across Halloween, Thanksgiving, and Christmas without blowing cash flow. Brands that surface installment pricing badges on PDPs, “just $25/month with BNPL”, convert hesitant shoppers, especially during Black Friday electronics deals. The key is balancing accessibility with risk, ensuring BNPL drives AOV without spiking returns.

10. Voice & Visual Search Adoption

Search behavior is no longer just text-based. Discovery is becoming multimodal, and voice and visual search are a must for your BFCM checklist.

More consumers are using Google Lens, TikTok’s visual search, and Alexa voice queries to find products by describing or showing, not typing. Think of a shopper scanning a Halloween candy bag to find the cheapest bulk option, or asking Alexa for “best Black Friday smart TV deals.”

For brands, PDPs must be search-friendly beyond text; with rich imagery, video, schema, and alt-text to capture traffic. The brands that invest here will future-proof visibility across searches on emerging social ecosystems.

READ MORE | Prepare right for Q4 with E-Commerce Holiday Readiness: Essential Guide for Brands.

The Smart Shopper: Value, Quality, and the Rise of Resale

Taken together, these trends paint a picture of the 2025 holiday shopper as deliberate, pragmatic, and digitally empowered. They’re buying Halloween candy early to manage budgets, jumping on Black Friday doorbusters for high-ticket items, and using Cyber Monday as the final sweep for missed deals.

They are using AI and mobile savvy to make quick, informed choices. And they’re not only stretching dollars but aligning purchases with personal values and sustainability.

Simon-Kucher shows households are prepared to spend 6% more overall if they believe in the value. McKinsey shows they’re willing to trade down if trust or quality feels uncertain. The consumers are not buying less; they’re buying smarter, earlier, and more intentionally for holiday shopping in 2025.

Growth Tips & Takeaways for Brands for Holiday Season 2025

Based on the holiday shopping insights and forecasts, here’s what you can do to win in Q4:

- Front-load demand: Treat Halloween as the kickoff. Launch gift-guide content and loyalty previews in October; don’t wait for the peak to start storytelling. Your holiday season planning must span the entire arc.

- AI-enable your shelf: Deploy gift finders and PDP chat that can compare Black Friday bundles and recommend alternatives by attributes, reviews, and availability.

- Creators + RMNs: Fuse creator content with retail-media audiences to win high-intent queries and social proof.

- Optimize for mobile: If mobile will drive a major share of net ecommerce gains, enhance mobile UX, default to wallets, and simplify checkout.

- Operationalize BOPIS: Push store-level availability and pickup ETAs on PDP/cart; prepare for a BOPIS surge near Halloween and Christmas.

- Offer BNPL responsibly: Badge installments on mid/high-ticket SKUs, especially in Cyber Monday tech and premium toy categories; track return/charge-off risk.

- Lean into re-commerce: Launch certified refurbished SKUs and trade-in credits; position “pre-loved” as smart and sustainable.

Final Notes

The holiday season has long been the make-or-break quarter for retailers. The predicted holiday shopping trends in 2025 reveal that the rules of engagement are changing faster than ever.

The US consumer is no longer following the traditional November–December script. Instead, they’re spreading their spending across Halloween, Black Friday, Cyber Monday, and even earlier windows, while relying heavily on mobile, AI, and flexible payments.

Brands that have already started acting on these holiday shopping insights will be the winners in Q4!

Looking to get granular holiday category, channel, and competitive insights? With MetricsCart, track digital shelf performance, monitor pricing and promotions, optimize omnichannel strategies, and stay ahead of holiday trends.

MetricsCart‘s suite of digital shelf analytics tools provides the data intelligence you need to optimize digital shelf execution and holiday strategy for the busiest quarter of the year. Book a demo today to get started!

Stay Ahead of Holiday Shoppers This Q4! Optimize Your Digital Shelf Today

FAQs

Early shopping, AI-powered personalization, mobile commerce, social proof, flexible payments, and re-commerce are key trends shaping consumer behavior in the holiday season 2025.

Omnichannel integration, AI-driven personalization, and seamless mobile experiences will dominate, with consumers prioritizing ethical and value-driven purchases.

Consumers are expected to spend cautiously, focusing on value, quality, and personal relevance. Selective shopping and early purchases are becoming the norm.

According to Deloitte, US holiday retail sales are projected to grow 2.9-3.4%, reaching $1.61-$1.62 trillion, with e-commerce leading growth at 7-9%.

Labor Day, Black Friday, Cyber Monday, and post-holiday clearance events provide the most significant savings across categories.