For startups and challenger brands, speed is survival. The ability to spot an opening in the market and move before competitors defines whether a new product thrives or fades into obscurity.

But in e-commerce, where established players dominate, traditional market research is too slow and too broad.

By the time reports land on the table, competitors have already adjusted their pricing, launched new SKUs, or intensified their promotions. This is where competitor analysis for startups comes into the picture.

Digital shelf where shoppers search, compare, and buy, and where every competitive move leaves a trace.

With the right digital shelf analytics software, startups can turn this data stream into a competitive radar, tracking rivals in real-time, identifying gaps in assortment or execution, and translating signals into growth plays.

This post examines how startups can conduct competitor analysis on a budget for whitespace discovery and category expansion.

Why Should Startups Use Digital Shelf Analytics For Competitor Analysis?

Since the digital shelf encompasses everything a shopper sees online, including search results, product pages, images, reviews, pricing, availability, etc., it updates constantly, reflecting every stock-out, promotion, and algorithm shift.

For digitally native brands, this immediacy is invaluable. Traditional brands often require weeks to respond to competitive shifts due to the need for layered approvals and rigid planning cycles. Startups, by contrast, can act in days or even hours. The challenge is not access to opportunity; it’s recognizing signals fast enough and prioritizing them correctly.

Digital-shelf analytics make that possible. They provide structured visibility into:

- Search ranking and share of search – who dominates the keywords customers actually use.

- Assortment and out-of-stock tracking – which SKUs are missing from retailers or categories.

- Price and promotions – changes that influence shopper choice in real time.

- Reviews and sentiment – what customers love or hate about competitor products.

- Content quality – whether rival listings meet best practices for conversion.

What Data Signals Should Small Businesses Monitor To Track Competitors Online?

The digital shelf produces thousands of signals daily. But not every signal is equally useful. Here are some key areas to focus on when conducting a competitor analysis for startups.

Search Rankings

Search is the entry point for most online shopping. Tracking keyword rankings reveals which brands are gaining visibility and which are losing ground.

Small businesses should check keyword position shifts for target terms (including head and long-tail keywords). If a product drops from position 2 to 6 for a high-traffic keyword like “organic protein bar,” that can mean substantial lost traffic. Additionally, they should analyze retailer-specific ranking differences, keyword gaps, and other relevant factors.

Ranking shifts can reveal changes in competitor strategy (new ad spends, SEO improvements) or algorithm updates.

Assortment Gaps

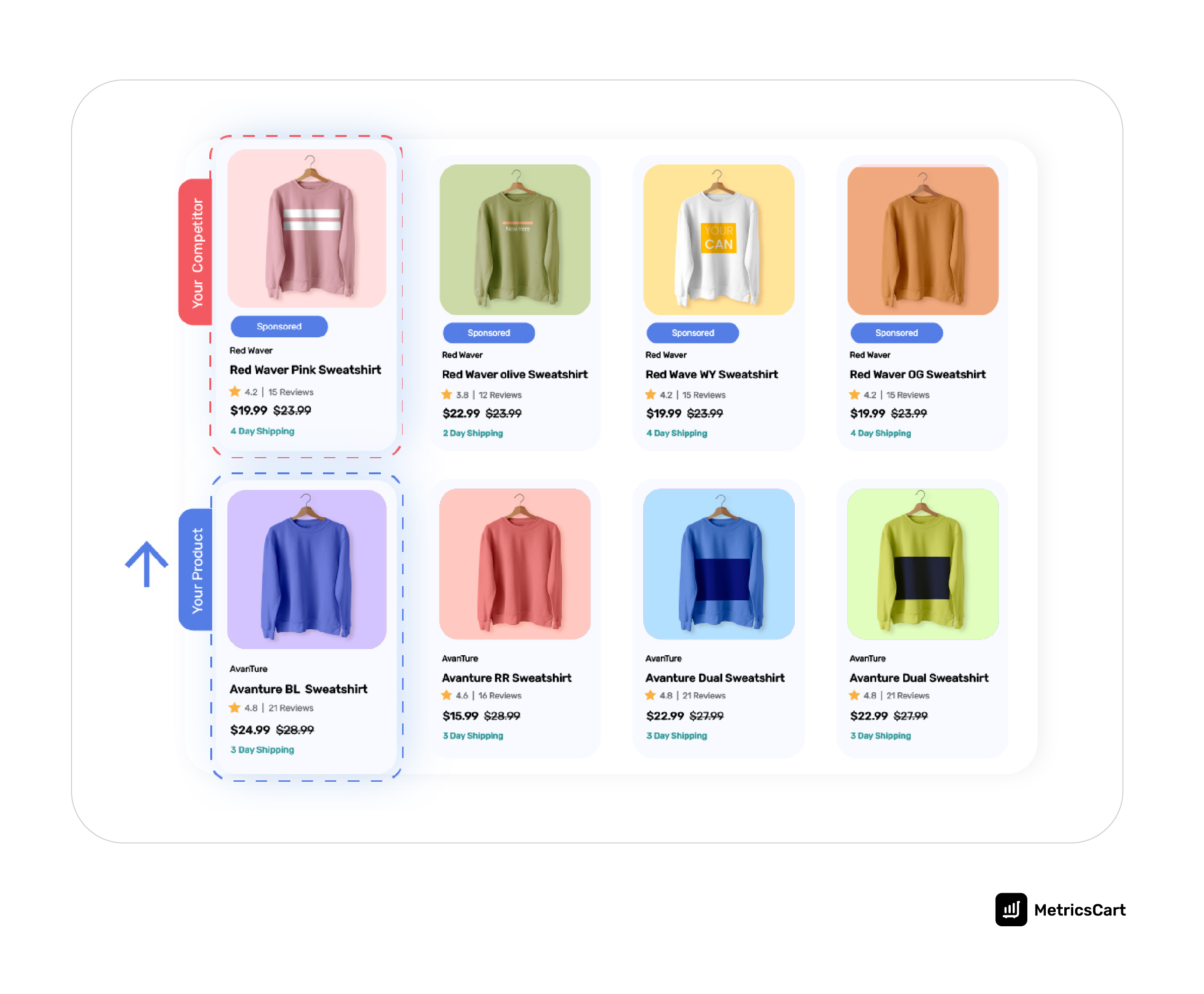

Assortment analysis determines whether competitors cater to the full spectrum of consumer needs. Assortment gaps are where consumer demand isn’t fully met. These can include gaps in product formats, variants (such as flavors, colors, or sizes), bundles, or even newer subcategories.

For lean teams in the CPG sector, identifying a gap early gives a first-mover advantage. If no sugar-free version exists in a growing subcategory, or if competitors only sell large packs where smaller formats are in demand, that’s a white-space waiting to be filled.

Availability

When a popular competitor’s product goes out of stock (OOS), it creates an opportunity. Out-of-stock (OOS) monitoring is one of the fastest paths to market share. When a leading SKU disappears from digital shelves, shoppers often switch. Challenger brands ready to fill that gap can capture demand without massive marketing spend.

Therefore, they must examine the frequency and duration of stockouts, stock levels across retailers and regions, customer substitution behaviors, and reviews about availability.

Pricing and Promotions

Pricing and promotions are among the most visible competitive levers. They influence perception of value, margin, and relevance. Promotions also tend to be short-lived, so detecting them early is crucial.

While conducting competitor analysis, start-ups should monitor not just whether a product is discounted, but how deep, how often, and for how long. A competitor offering 30-50% off frequently, versus another offering 10% less, can alter shopper expectations.

It is also essential to track MAP violations or undercutting, particularly on marketplaces, where unauthorized sellers list below the MAP, thereby harming both brand value and margins.

Reviews and Ratings

Customer reviews offer insights that market surveys often overlook. If buyers repeatedly complain about packaging, sizing, or durability, startups can design alternatives that directly solve these pain points. Positive sentiment patterns also highlight features worth replicating or amplifying.

In Episode 4 of the Digital Shelf Insider podcast by MetricsCart, Irina Zagradskaya, E-Commerce Team Lead at Accel Club, shares insights on navigating marketplace compliance and leveraging customer feedback for brand growth. Watch full episode here:

Data points such as rating trends over time, review recency and volume, sentiment analysis, thematic analysis, and review gap vs competitors are some metrics that start-ups must analyze to gain a competitive advantage.

Content Quality

Strong product content, including complaint images, bullets, and A+ pages, directly impacts conversion. High-quality content builds trust and helps conversion.

While conducting competitor analysis for startups, some key things to audit include:

- Image quality and variety

- Titles, bullets, and descriptions

- Enhanced content / rich content

- Content compliance & accuracy

Identifying competitors with weak or inconsistent content creates opportunities for startups to outshine them with superior storytelling and visuals.

How Can Challenger Brands Turn Digital-Shelf Data Into White-Space Opportunities?

Baseline and Benchmarking

The first step is to establish a competitor universe that contains the 5–10 brands or SKU sets you will constantly monitor. These should include direct rivals in your niche, a few aspirational brands (stronger players you may want to outpace), and brands in adjacent categories whose moves might bleed into yours.

Map the top brands in your category across key retailers and benchmark their share of search, assortment breadth, and pricing tiers. This establishes a baseline for measuring change.

Gap Analysis

Once benchmarks are established, challenger brands can move to a structured gap analysis by methodically comparing what competitors currently offer with what customers may be seeking. This helps reveal white-space opportunities.

A practical way to do this is by creating a matrix of retailers, subcategories, and features, then highlighting areas where competitor coverage is missing or consumer needs are unmet. You can include:

- Variants (flavors, pack sizes, bundle offers)

- Format (liquid, powder, capsules, single-serve)

- Price tiers (budget, mid, premium)

- Functional or ingredient variations (e.g., sugar-free, organic, fortified)

- Seasonal or limited editions

Trend Detection and Anomaly Alerts

Digital-shelf data is dynamic. Without automation, you might miss the small but meaningful shifts that precede category shifts. This is where anomaly detection becomes critical.

You need to watch for:

- Sudden rank shifts (up or down) for core SKUs or competitors

- Sharp price changes (a drop, sudden discounting, or an unusually deep markdown) Review sentiment spikes (either strongly negative or positive)

- Unusual availability behavior (a sudden stock-out of a competitor SKU, or sudden replenishment after long absence)

- Promotional bursts (unexpected short-duration promos or bundles)

This allows startups to intervene before competitors react. Automated anomaly alerts ensure teams aren’t drowning in noise.

Opportunity Scoring

Not every gap or anomaly is worth pursuing, especially when startups have limited time and money. That’s why the final step is scoring each idea to see which white-space opportunities are most promising.

You can do this by looking at:

- Check keyword search volume, category growth, or the frequency of reviews for similar products to estimate demand. Higher demand means a higher score.

- If many brands already offer the same thing, score it lower. If few or none do, it’s more attractive.

- Some ideas are more expensive. Adjust the score down for expensive or low-margin options.

- Think about how quickly you can launch it and whether there are supply or regulatory hurdles. Easier, lower-risk ideas get higher scores.

- Give a boost to ideas that align with your positioning or offer unique benefits such as sustainability or new formulations.

Add up these factors to get an “opportunity score” and rank the gaps by score. This makes it easier to focus only on the ideas most likely to succeed.

What Tools And Tech Stack Do Digitally Native Brands Need For Competitor Monitoring?

A full-featured digital-shelf analytics stack typically includes:

- Continuous data collection across retailers and categories.

- Automated SKU mapping to align products correctly.

- Dashboards and visualizations for share of search, price trends, and reviews.

- Alerts and anomaly detection to flag competitive moves in real time.

- Review sentiment analysis to uncover hidden themes.

Startups don’t need to start big. Focusing on a few hero SKUs across two or three retailers is enough to establish early wins. From there, analytics can scale with the business.

Which KPIs and Dashboards Matter Most For Startup Competitor Analysis?

Startups should focus on a few high-value KPIs, such as:

- Share of search – % of top keyword results owned.

- Incremental traffic estimates – uplift from rank improvements.

- Time in stock – % of days products remain available.

- Price competitiveness index – relative to category average.

- Sentiment score – normalized customer feedback trend.

Turning Insights into Competitive Advantage

Competitor analysis is no longer about waiting for quarterly reports or industry surveys. For startups, the battle is decided on the digital shelf, where every price change, review, and stock-out creates an opening.

With the right digital shelf analytics software, like MetricsCart, data-driven teams can identify these signals early, pinpoint the gaps that incumbents overlook, and act before rivals even notice.

Startups don’t have the scale of legacy brands, but with speed, precision, and innovative use of digital shelf data, they can win category share one white-space at a time.

Ready to Improve Your E-Commerce Brand Performance?

FAQs

It provides startups with real-time data on competitors’ moves—such as pricing, stockouts, and reviews—so they can react more quickly and fill market gaps.

Search rankings, assortment gaps, pricing and promotions, availability (stockouts), reviews and ratings, and content quality are the key signals.

It’s an unmet customer need, such as a missing size, flavor, or price tier, that no competitor is serving well, which a startup can target.

Startups should focus on KPIs like search rank, share of shelf, stock availability, pricing trends, review sentiment, and content quality to gauge competitor performance. A simple dashboard that combines these signals in one view helps teams spot gaps, track changes in real time, and act quickly.

Use the data to identify white spaces: missing SKUs, flavor/variant gaps, pricing mismatches, etc. Then run small experiments (launch variant, content tweaks) and measure performance. Use opportunity scoring to pick what to try first.