Amazon is the largest e-commerce marketplace in the US. It holds 37.8% of the country’s online retail market, while its closest rival, Walmart, has only 6.3%. For brands, this makes Amazon indispensable for visibility and growth on the digital shelf.

However, selling on Amazon isn’t as simple as listing a product and watching it sell. Behind the scenes, Amazon runs on a strict system of performance, profitability, and operational metrics. Every product is evaluated on how well it sells, ships, and maintains margin efficiency. And when a product falls short of expectations, Amazon quietly flags it as CRaP or “Can’t Realize a Profit”, which is Amazon’s internal way of saying, “This product isn’t worth our effort.”

In this article, Amazon CRaP is explained in depth. You’ll learn what is Amazon CRaP, what causes it, and how leading brands are avoiding this trap.

What is Amazon CRaP

CRaP stands for “Can’t Realize a Profit.” It’s the internal term Amazon uses to describe products that fail to generate positive margins due to pricing, packaging, or logistics inefficiencies.

While the term might sound dramatic, the reasoning behind it is painfully rational. Amazon’s retail engine runs on thin margins and automation. If a product regularly loses money because it’s too heavy, too cheap, too discounted, or too frequently returned, the algorithm eventually classifies it as CRaP. Once that happens, Amazon starts phasing it out.

CRaP is not an official tag you’ll see in Amazon Seller Central. But its impact is very real, and often irreversible.

READ MORE | Ultimate Guide to Amazon A9 Algorithm: A Brand Perspective

How Amazon Determines CRaP Products

Amazon doesn’t label a product as CRaP based on a single metric. Instead, it uses a combination of profitability signals, operational costs, and sales performance to identify SKUs that don’t bring the profit it intends. Here’s how Amazon CRaP policy usually unfolds:

Margin Analysis

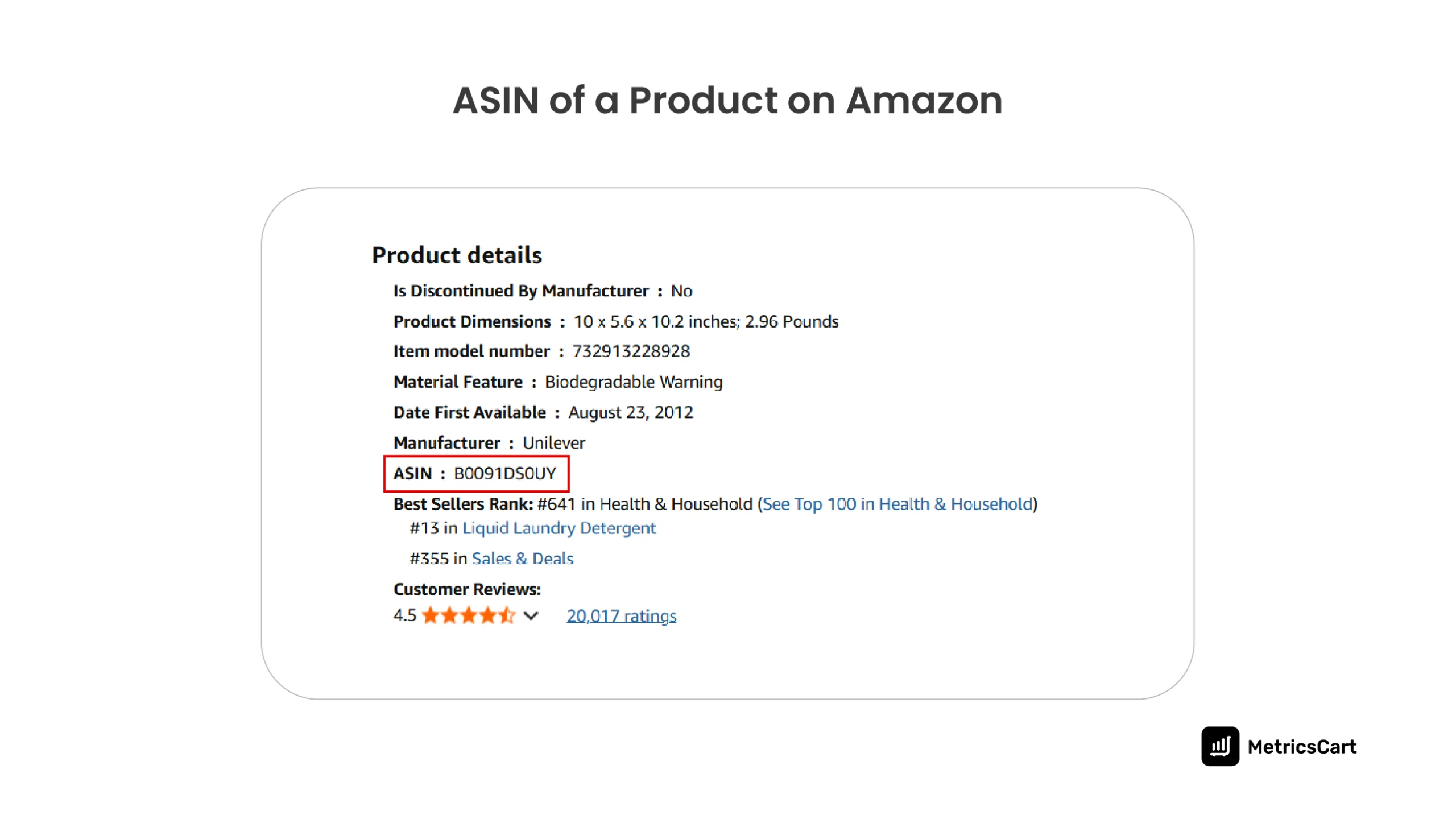

Every product listed on Amazon has a unique identification code, called the Amazon Standard Identification Number or ASIN.

Each ASIN is continuously evaluated for contribution margin that includes Amazon’s net gain after accounting for fulfillment, shipping, advertising, and other costs. If the numbers turn red too often, that’s the first warning sign.

Fulfillment and Handling Costs

Large, heavy, or irregularly shaped products increase FBA storage and transportation expenses. If the cost-to-weight ratio becomes inefficient, Amazon’s profitability algorithm flags it as a potential loss-maker.

Returns, Defects, and Customer Metrics

High return rates, poor reviews, or frequent replacements signal customer dissatisfaction. Amazon treats these as profitability risks since they add reverse logistics costs and lower customer trust scores for that ASIN.

Demand Volatility

Products with erratic sales patterns or seasonal spikes can lead to overstocks or storage write-offs. Amazon’s systems favor consistent sellers, so irregular demand often contributes to CRaP classification.

MAP Violations

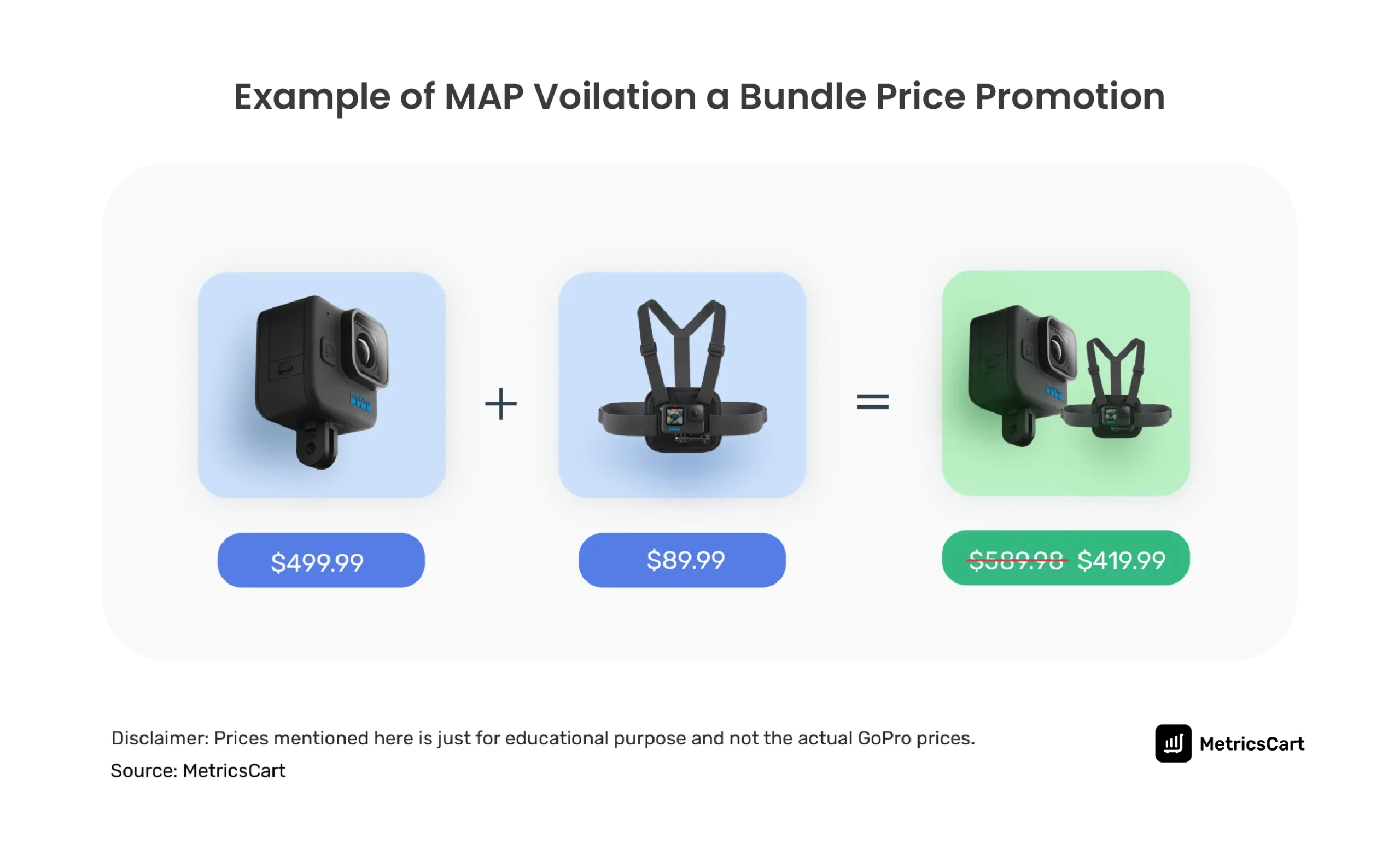

When unauthorized resellers consistently list your product below the Minimum Advertised Price (MAP), it erodes both brand equity and profit margins. These violations create a pricing cascade that can push your product into unprofitable territory.

READ MORE | 7 Reasons Why MetricsCart Is the Best for MAP Monitoring & Enforcement: A Brand’s Perspective

Signs Your Product Is at Risk of CRaP Status

Amazon rarely tells you directly that your product is about to be CRaPped. But there are subtle signs that should set off alarms:

- Removed from “Subscribe & Save” or “Amazon’s Choice” listings.

- Sudden drop in purchase orders or reorders (for Vendor Central brands).

- Ineligibility for Amazon Advertising campaigns.

- Disappearing from Buy Box rotation or suppressed listings.

- Frequent price reductions triggered by algorithmic matching.

- Sudden inventory stagnation, i.e, Amazon stops restocking even when sales are stable.

When multiple of these signals appear, it usually means Amazon’s profitability model has started treating your product as a liability.

READ MORE | Frequently Asked Questions About Amazon Buy Box

Impact of CRaP on Your Business

Once a product is flagged as CRaP, the impact on a brand is immediate and often difficult to reverse. Amazon quietly begins restricting the product’s presence and support across multiple layers of its retail ecosystem.

The typical consequences include:

- Fewer purchase orders from Amazon Retail (1P), reducing inventory flow.

- Loss of Buy Box eligibility, which sharply lowers conversion rates.

- Reduced search visibility because the item no longer receives algorithmic promotion.

- Ineligibility for paid advertising, including Sponsored Products.

- Lower organic ranking due to weaker sales velocity and suppressed placement.

- Damaged price perception, as Amazon stops funding margin protection.

- Higher operational burden, since brands may be forced to shift to 3P to keep selling.

CRaP isn’t just a profitability problem. It’s a visibility, reputation, and data problem that compounds over time. The earlier brands detect it, the easier it is to reverse.

READ MORE | Amazon 1P vs. 3P: Choosing the Right Selling Model

How to Avoid Amazon CRaP Status

The key to preventing Amazon CRaP status is making sure Amazon earns profits through your product. Here are a few tips you can follow to ensure your product’s profitability:

Keep Pricing Consistent Across Channels

One of the fastest ways to trigger CRaP is price erosion. If your product sells cheaper elsewhere, Amazon automatically matches that price, even if it means losing margin. The fix is simple: tighten reseller policies and keep MAP compliance in check.

Successful brands do minimum advertised price tracking using tools like MetricsCart. It enables them to identify unauthorized sellers and prevent undercutting before it damages profitability.

READ MORE | Amazon MAP Enforcement: A Complete Guide for Sellers and Brands

Streamline Packaging and Fulfillment

Many products end up on the CRaP list not because they don’t sell, but because they’re too costly to move. Heavy or oversized items increase shipping, storage, and handling expenses that chip away at margins.

Brands that perform well on Amazon routinely review packaging design, reduce dimensional weight, and consolidate shipments. Even small changes, like flatter boxes or lighter materials, can make a measurable difference in fulfillment efficiency.

Maintain Steady Sales and Product Health

Amazon rewards stability. Products with consistent demand, low return rates, and positive reviews rarely face CRaP risk. So, monitor return and defect trends, respond to customer feedback quickly, and plan inventory around realistic forecasts.

By tracking sales velocity and conversion data regularly, you can spot early warning signs and act before Amazon’s system steps in.

In episode 37 of the Digital Shelf Insider podcast, Martin Heubel, Amazon Consultant and the founder of Consulterce, shed light on Amazon’s automated systems, new negotiation tactics, Amazon CRaP items, tips to prevent delisting, and more.

Watch the full episode here:

No More CRaP

CRaP is not just an algorithmic penalty. It is Amazon’s signal that the product no longer makes financial sense for the platform to carry. Once that signal is triggered, recovery becomes harder with every missed sale, price match, or fulfillment cost spike. The most successful brands are the ones that treat CRaP prevention as an ongoing discipline rather than a one-time fix.

The core defense is profitability visibility, knowing when pricing is eroding, when packaging is driving up cost-to-ship, and when returns are quietly eating into margin. And to do that efficiently, you need minimum advertised price tracking and enforcement tools like MetricsCart. So that you can prevent margin leaks before Amazon’s system marks your product as CRaP and starts pulling back visibility.

Prevent Your SKUs from CRaP Status using MetricsCart.

FAQs

Yes, but it requires addressing the root causes. Brands can optimize packaging, improve margins, and stabilize pricing to make the product profitable again. Once performance data improves, Amazon may resume normal support.

CRaP mainly affects Vendor Central brands since Amazon buys products directly from them. Seller Central users manage their own margins and pricing, giving them more control but also more responsibility for profitability.

Leading brands review profitability and MAP compliance weekly or monthly. Regular monitoring helps catch small margin issues before they become system-level red flags.

No. Amazon doesn’t send explicit alerts when a product becomes CRaP. The signs are indirect—fewer purchase orders, reduced ad visibility, and declining search performance. Proactive tracking is the only reliable prevention strategy.