Andrew Lipsman, Principal Analyst at Insider Intelligence, says “Winning at the digital shelf is more critical than ever for CPG brands.”

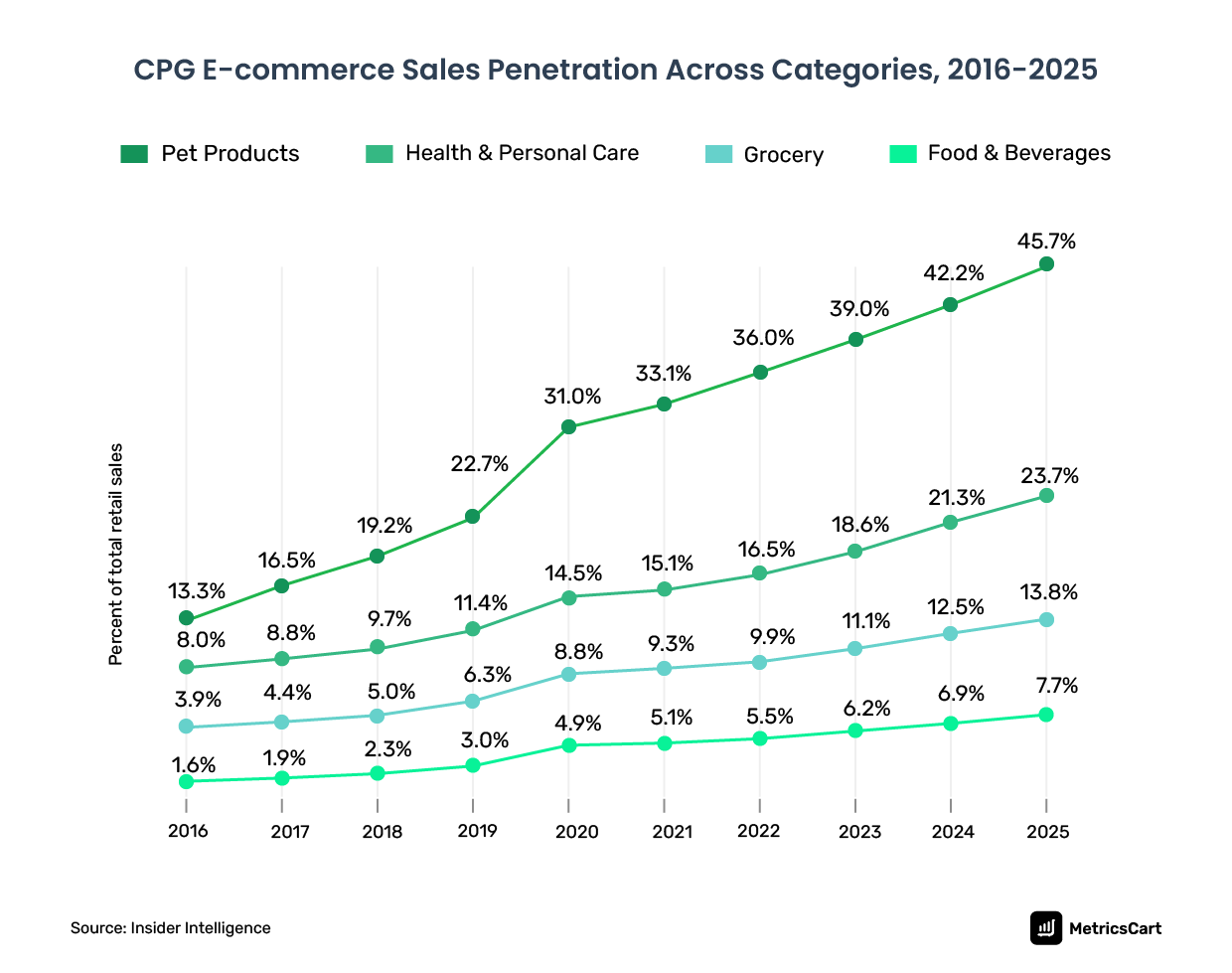

In 2022, the pet category items hit 36% e-commerce penetration followed by health and personal care products. All the categories are expected to achieve steady growth in the coming years as seen in the chart.

However, with a huge e-commerce opportunity, grocery brands will have to explore competitive pricing and marketing across channels to win shoppers.

[table_of_contents numbered=true]

Since 2016 until now, the CPG segment has been the second biggest spender on digital ads after retail.

Six Shopper Attitudes Driving CPG E-Commerce Growth

Consumers Expect Personalized Efforts From Brands

A McKinsey study states that 76% of consumers expect some level of personalization when shopping CPG categories.

Tia While, GM of Artificial Intelligence and Machine Learning at Amazon Web Services, said “CPG companies that invest in personalization typically grow 33% faster than companies that do not, and they see [at least] a 20% impact on their bottom line.”

Additionally, during the Grocery Shop 2023 conference, unified shopping experiences were one of the key takeaways for grocery executives. Speakers at the event looked at the different personalization approaches grocery brands could adopt to meet the customers where they are.

The term “unified shopping” was seen as a replacement for omnichannel, which carries multiple connotations. A customer-centric shopping experience across all channels, QR codes, smart shelves, and shopping carts are just a few innovations to reshape the traditional grocery store models.

Related read: Everything you need to know about shopper marketing

Smaller Pack Sizes Are the New Incremental Driver of CPG Growth

According to the Bloomberg Intelligence analysis of S&P 500 companies, there are two consumer spending patterns in the face of inflation. On one side, price-sensitive consumers are stressed by increasing prices. At the same time, some shoppers don’t care much about inflationary pressures.

As a solution to price-sensitive consumers stressed out by increasing prices, CPG brands are remodeling their pack sizes across categories. Molson Coors CEO Gavin Hattersley said, “Consumers are seeking more value through purchasing decisions, whether into smaller pack sizes like singles or six-packs or large pack sizes like 30-packs.”

Crown Holdings, a leading packaging solutions provider, stated that with the shift to healthier beverage options, there is an increase for specific categories in the 7.5oz can size. This offers consumers a smaller serving size and less guilt.

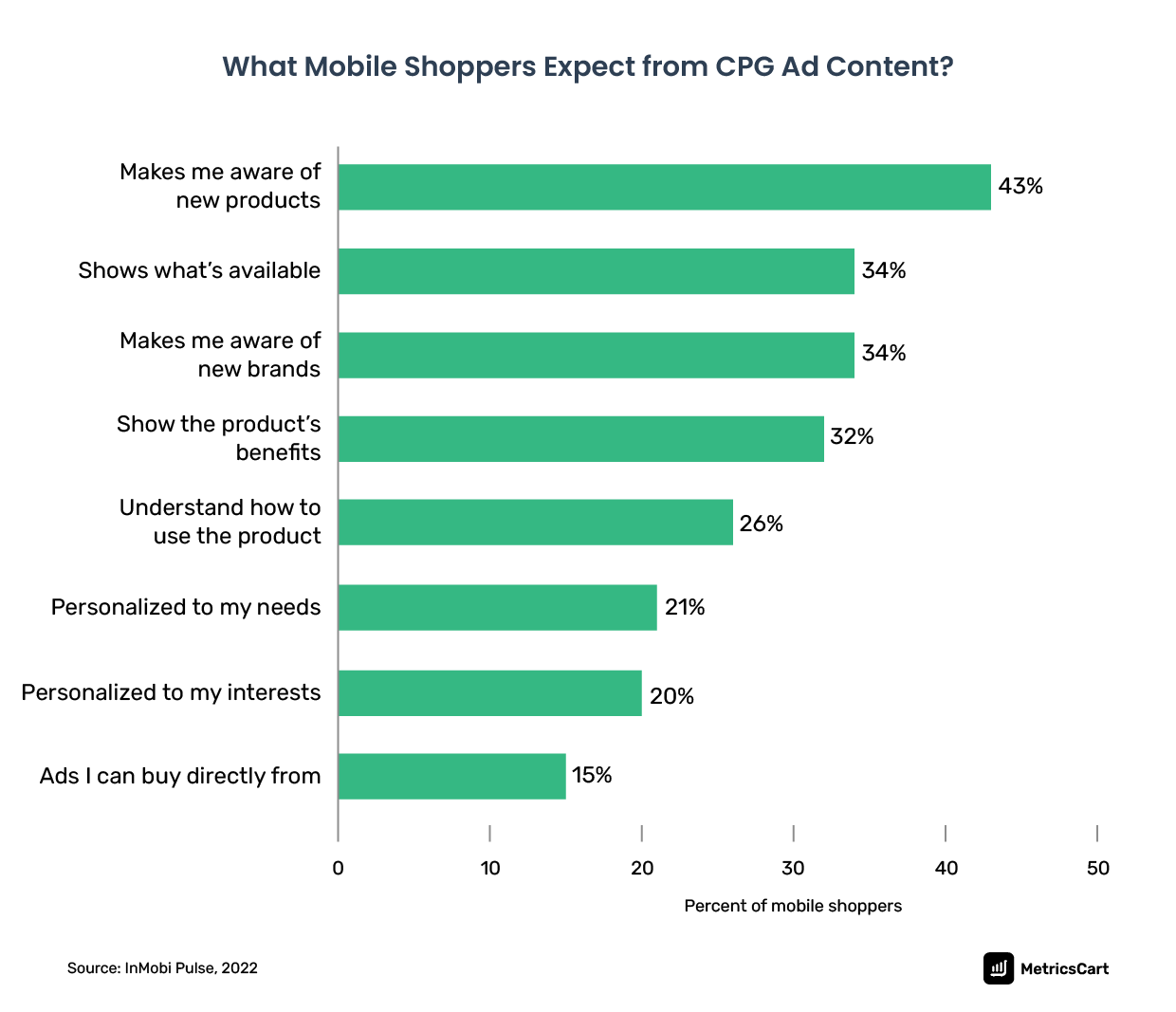

Shoppers Love CPG Ads That Make Them Aware of New Products

In 2023, the CPG segment is the second-highest spender on digital ads after retail. It consistently followed retail spending since 2016. In 2022, CPG brands spent $3.7 billion on digital ad formats. This was spent mostly across five categories:

- Snacks and desserts

- Household products

- Skincare

- Cosmetics

- Hair care

Inmobi findings show that 43% of consumers love to discover new CPG products through ads in the US.

In most cases, CPG brands sell their products through third-party sellers, so brands don’t have access to customer data. As a result, CPG brands rely on behavioral and demographic targeting to drive brand awareness. Gender, age group, device type, and shopping habits are some of the factors to target consumers online.

With the launch of the retail media networks (RMNs), brands on the digital shelf get more visibility. For instance, a snack brand on Amazon can now target shoppers who have previously bought from the brand. This became possible with access to first-party customer data and targeted advertising solutions through RMNs.

Learn How Successful CPG Brands Talk to Customers From Retail Shelves

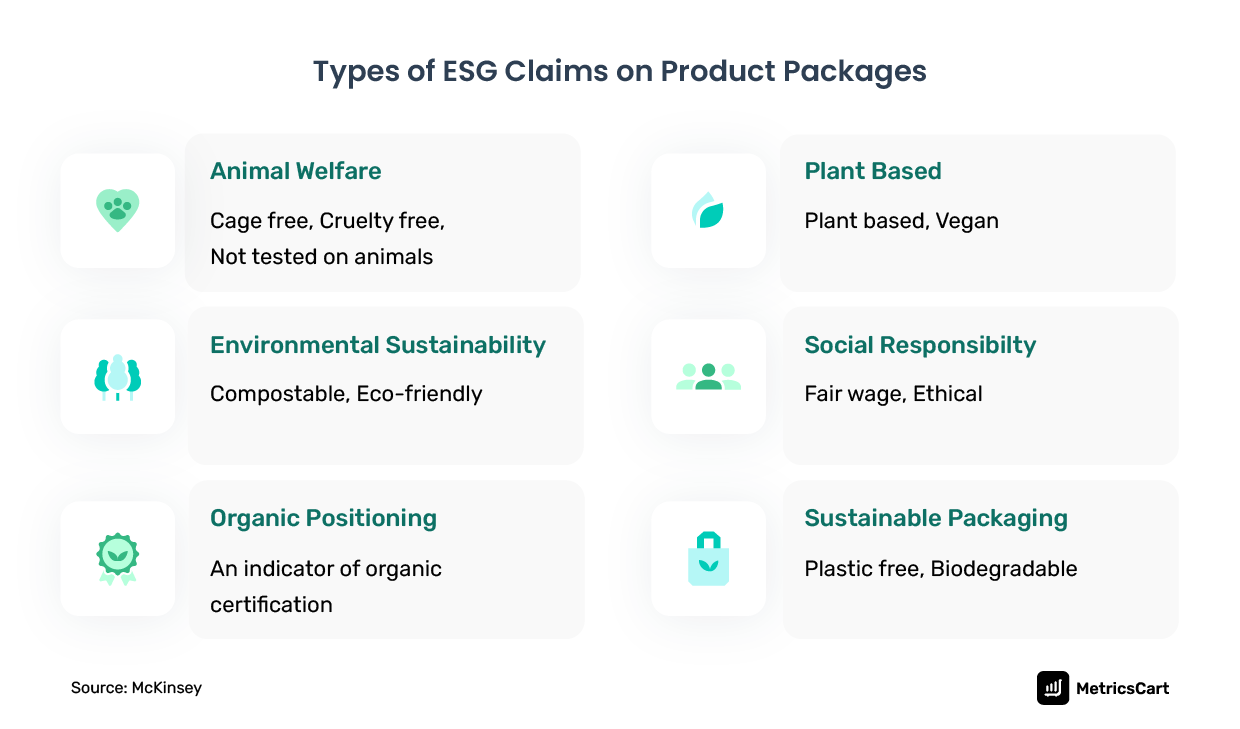

Consumers Care About Environmental, Social, and Governance (ESG) Claims Made by Brands

Between 2017 and 2022, McKinsey and Neilsen IQ teams analyzed 44,000 CPG brands. The brands ranged across food, beverage, personal care, and household categories. They identified 93 claims ranging from cage-free, eco-friendly, and others.

The study found 28% cumulative growth for brands that used ESG claims versus 20% growth for brands that didn’t use such claims. Certain categories such as children’s formula or nutritional beverage purchases were driven by clinical recommendations and were not ESG claims related.

However, the US took several steps in 2023 to add to its guidance and enforcement mechanisms related to green advertising.

Read more: Amazon Shopper Behavior Decoded

Promotional Pricing Is the Way To Bring Back Consumers in a Cost-Of-Living Crisis

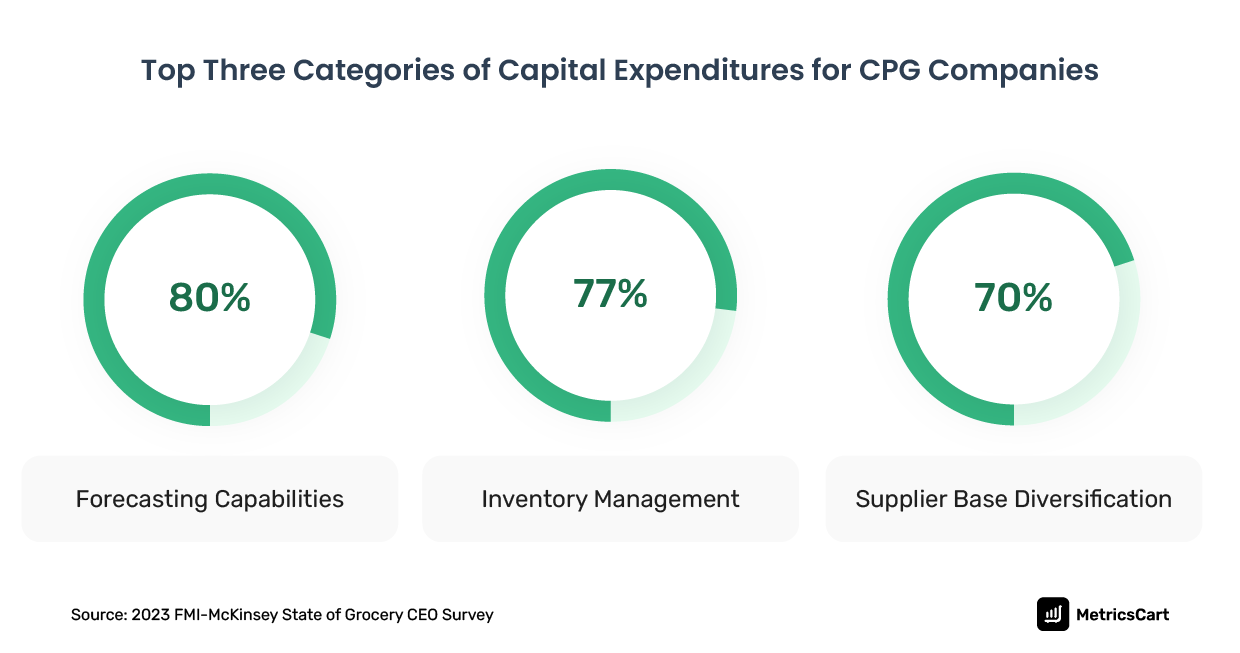

Between 2020 and 2022, the capital expenditure of many CPG companies was on the rise. Forecasting capabilities, inventory management, and supplier base diversification were the top three categories where investments flowed. This resulted in increasing prices across products.

PYMNTS Consumer Inflation Sentiment Report revealed that:

- 57% of consumers reported having cut down on nonessential grocery spending.

- 36% of grocery shoppers had begun switching to private-label brands.

As inflation normalizes now, United Natural Foods, Inc. (UNFI), a natural and organic food company, expects to bring back shoppers more deals and discounts. Kroger shared in its recent earnings call that it saw a 29% increase in digital coupon downloads last quarter.

Read more: Role of Online Trade Promotion Optimization

One Out of Three Shoppers Aren’t Loyal to Brands Anymore

Morning Consult’s recent research shows that 77% of Gen Zers are willing to try new brands, particularly in grocery, beauty, and personal care. This leads to a more open market and forces legacy brands to seek innovation. Studies also predict Gen Z to have the largest population of 82 million by 2026.

David Villa in his Forbes article summarized this shift, “Modern consumers are not enthralled by the name of a company. Instead, they disregard those who fail to see the bigger picture.”

Another research from InMobi in 2022 shows that pet category consumers are most brand loyal. Baby category consumers are the least brand loyal and easily switch to private label brands. Some of the top motivators include:

- Availability

- Price

- Quality

- Speed

Moreover, the study also found that CPG brands partnering with retailer loyalty programs experienced improved product loyalty.

Read more: What CPG brands are doing to win on the digital shelves?

CPG Categories with a Growth Potential in E-Commerce

Chris Perry, the Chief Learning Officer at Firstmovr, a CPG change management and educational platform, discussed in a webinar the e-commerce forecasting mistakes CPG brands make across different categories.

With no single universal source of truth to use as a metric to set e-commerce goals, the common mistakes include:

- Relying on the brand’s sources of market and partial data

- Underestimating and misrepresenting the potential of emerging business models

- Solely looking at a brand’s digital penetration without a categorical or competitive perspective

Having a clear competitive and categorical breakdown of data from a single dashboard gives CPG brands the utmost clarity in their investment planning for e-commerce.

As the line between digital and physical stores blur, CPG brands that adapt to the e-commerce business model and monitor the digital shelf to meet customer needs increase their probability of making profits.