Global Retail Brands 2024 supplier guide reveals that almost one in five consumer goods products in the US is a private label. Over the years, private-label brands have witnessed steady growth, securing 19% of the US market share in 2023.

This growth spans multiple categories, including food, beverages, beauty, and home products. Retail giants like Amazon, Walmart, and Target have their fair share of successful private-label lines.

Target Good and Gather and Walmart Bettergoods are two such private-label food and beverage brands.

About the Report

MetricsCart’s Digital Shelf Insights is a monthly report in which our data experts analyze various brands and categories.

This report aims to conduct a comparative study of private-label brands Good & Gather and Bettergoods. Both offer products such as sauces, frozen foods, snacks, produce, dairy, meat, seafood, etc.

Methodology

In this latest edition of MetricsCart reports, we analyzed 119 Bettergoods on Walmart’s digital shelf and 846 Good and Gather products on Target in July 2024.

Key Findings

- The most expensive Bettergoods products are BBQ sauces and sea salts.

- Dry fruits are the most expensive Good & Gather Products

- The average rating of Good and Gather is higher than Bettergoods at 4.49

- Distilled water is the most reviewed Good and Gather product

Target Good & Gather Vs. Walmart Bettergoods: Product Overview

Target launched its largest-owned food & beverage brand, Good & Gather, in April 2019, with products that prioritize taste, quality ingredients, and ease at a great value. In 2021, they released the Good & Gather Plant Based, a new line featuring plant-based creations at affordable prices.

According to Erica Thein, VP of Food & Beverage Owned Brands at Target, Good & Gather’s roughly 2,500 product offerings generated over $3 billion in sales in 2022 alone.

Some of the major sub-categories of Good and Gather include:

- Meat & Seafood

- Dairy and Deli

- Snacks

- Sauces, Salsa, and Marinades

- Frozen Foods

Based on the MetricsCart study, Good and Gather also offer 458 allergens-free products.

On the other hand, Bettergoods was released in April 2024 to provide a new elevated experience that delivers quality, unique, chef-inspired food at lower prices. Upon launch, Bettergoods had roughly 300 items spanning Walmart’s aisles.

Some of the major sub-categories of Bettergoods are:

- Snacks

- Seasonings, Mixes, & Blends

- Frozen Appetizers

- Dairy Products

- Cookies and Pantry Meals

In addition, this Walmart private label brand offers a wide variety of options that cater to different dietary lifestyles, like gluten-free or made without artificial flavors, colorings, or added sugars. MetricsCart data experts identified 25 gluten-free Bettergoods products.

While they offer similar products, their prices and customer perception vary. Let’s examine the pricing and review analysis of Walmart’s Bettergoods and Target’s Good and Gather.

READ MORE | Want to Know About AmazonBasics- Amazon’s Private Label Brand? Check out Digital Shelf Insights: Top Amazon Basics Product Categories

Target Good & Gather Vs. Walmart Bettergoods: Pricing Analysis

In this section, let us conduct a price comparison of Good & Gather and Bettergoods products.

BBQ Sauces are the Most Expensive Bettergoods Products

As per the study conducted in July, BBQ sauces and sea salt are the most expensive Walmart Bettergoods products.

Studies forecast that the barbecue sauce market will grow from $89 billion in 2024 to $2.56 billion by 2032.

The most expensive Walmart Bettergoods products in July are Raspberry Chipotle BBQ sauce, Spicy Pineapple Habanero BBQ sauce, and Traditional Competition-Style BBQ Sauce. All these sauces cost $30.

This is followed by Fleur De Sel French Sea Salt and Cyprus Flake Sea Salt, which cost $17.9 and $13.5, respectively.

Peanut Oil is the Most Expensive Target Good and Gather Product

MetricsCart’s market intelligence analysis revealed that peanut oil is the most expensive Good and Gather product. However, compared to the average market price, Good and Gather peanut oil is affordable at $18.

Other than peanut oil, dry fruits are the most expensive products at Target’s Good and Gather. This includes chopped pecans and almonds & cashews variety pack, which costs around $17 each.

Least Expensive Products of Walmart Bettergoods and Target Good and Gather

Both Target and Walmart launched Good and Gather and Bettergoods to provide high-quality products at cheaper rates.

In July 2024, the most affordable Bettergoods product was soft-baked lemon chiffon cookies at $2.08.

Apart from this, Bettergoods also offers a lot of plant-based products at lower prices. This helps to make plant-based products accessible to more customers, as 70% of all US citizens ate plant-based foods in 2023, up from 66% in 2022.

The Bettergoods Plant-Based Chocolate Almondmilk, Plant-Based Original Almondmilk, and Unsweetened Original Almondmilk are available at $2.44.

Target offers numerous staple products for less than $1. At $0.59 and $0.69, Good and Gather offers tomato sauce and salt.

In addition, cut green beans and golden sweet whole-kernel corn are priced at $0.75. Cut green beans have a 5-star rating with 1101 reviews. Similarly, golden sweet whole-kernel corn also has a 5-star rating with 1537 reviews. This indicates that the products are cheap and a customer favorite.

READ MORE | Interested in More Brands and Categorieson Walmart? Check out Digital Shelf Insights: Walmart Beverages Category Analysis Report

Ratings and Review Analysis of Target Good & Gather and Walmart Bettergoods

Using the MetricsCart rating and review analysis platform, our experts have analyzed how customers perceive these two brands.

Bettergoods and Good & Gather have a total of 1051 and 49K reviews, with an average rating of 3.93 and 4.49, respectively.

With a 4.1 rating and 47 reviews, Plant-Based Salted Caramel Oatmilk Non-Dairy Frozen Dessert, 16 fl oz, is the most preferred product in Walmart Bettergoods.

The customer sentiment analysis showed that consumers loved this product because it is vegan, creamy, flavorful, and non-dairy.

Unsweetened vanilla almond milk, assorted macarons, and chicken wings with garlic butter dry rub are the other Bettergoods products with the highest reviews. They have received 44, 37, and 32 reviews, respectively.

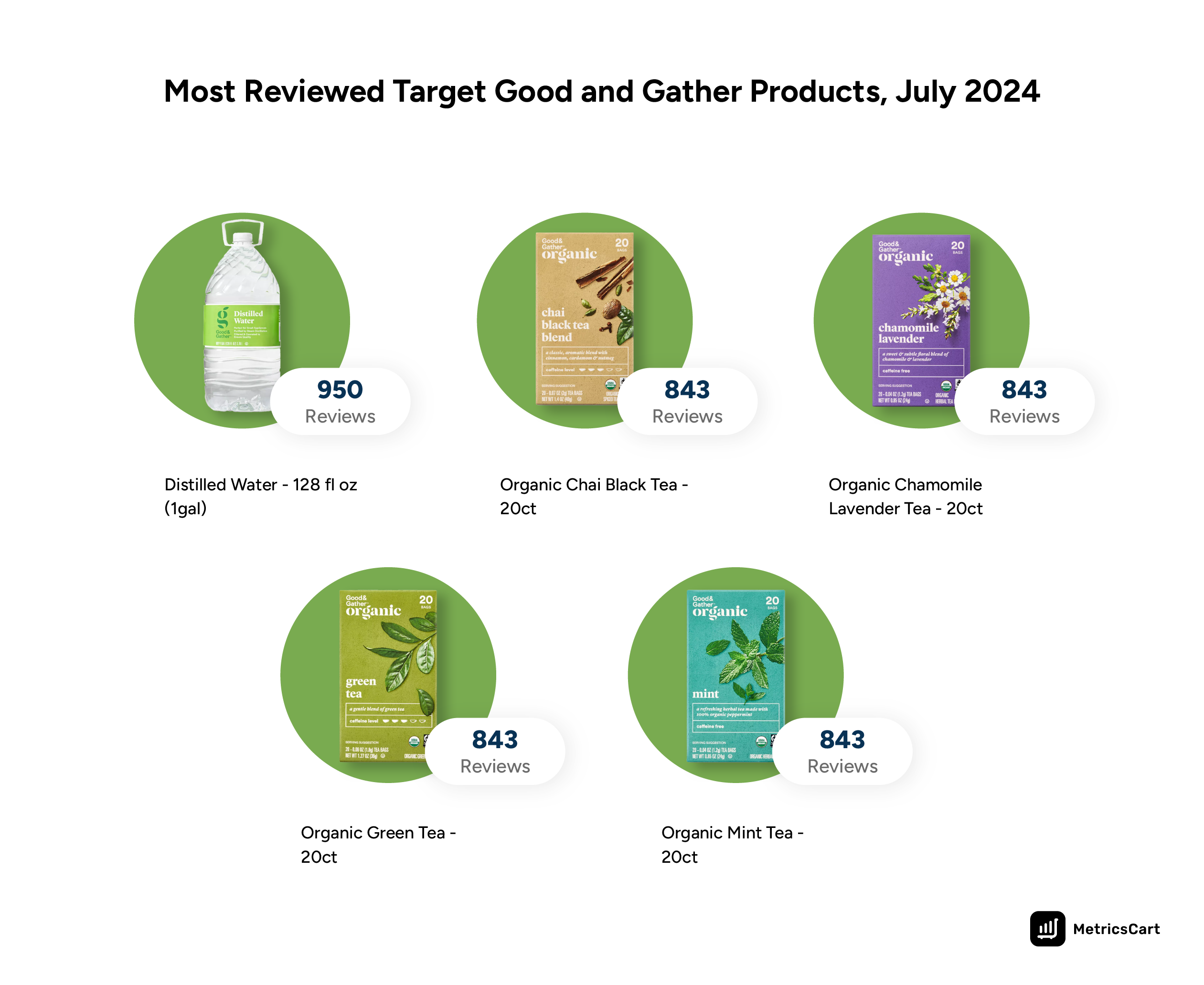

Based on the review analysis conducted on Good and Gather products, distilled water has the highest number of reviews, at 950, with a 5-star rating.

Other most reviewed Good and Gather products are organic chai black tea, organic chamomile lavender tea, organic green tea, and organic mint tea. All these tea varieties have 843 reviews. Shoppers love the smell and organic ingredients and consider them suitable for both hot and iced tea.

Conclusion: Decode Brand Insights with MetrisCart

Target’s Good & Gather and Walmart’s Bettergoods are two significant players in the private-label food and beverage sector.

While both brands cater to similar categories, their pricing strategies and consumer ratings reveal distinct differences. Good & Gather’s higher average rating and broader product range indicate consumer satisfaction and brand loyalty. In contrast, Bettergoods, with its focus on affordable, chef-inspired offerings, appeals to a different segment of the market.

For businesses looking for similar insights into brands and competitors to optimize their strategies, MetricsCart provides the tools and insights necessary to stay ahead. With real-time data on pricing, inventory, and consumer sentiment, MetricsCart digital shelf analytics software empowers brands to make informed decisions and enhance their e-commerce performance.

Contact us today to learn how MetricsCart can provide category insights to enhance your position in the e-commerce landscape.

Disclaimer: MetricsCart is the exclusive owner of data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.