About the report: This digital shelf insights report provides a detailed comparison of Minimalist on Instamart vs Blinkit, examining how the beauty brand performs across both quick-commerce platforms in Delhi. The analysis is based on data collected from September 8–22, 2025, and explores key factors such as product pricing, availability, discount strategies, and delivery efficiency.

Introduction

Minimalist is a fast-growing skincare brand that has built a strong presence in India’s $33 billion beauty market through a transparent, science-led approach to product development.

Founded in 2020, the brand initially made waves through its direct-to-consumer (D2C) strategy, offering high-performance products at accessible prices. Over the years, Minimalist expanded its portfolio across skin, hair, and body care, quickly scaling its operations while staying true to its ethos of ingredient transparency.

As consumer expectations shifted toward speed and convenience, Minimalist entered the quick commerce (Q-Comm) space, partnering with platforms like Instamart and Blinkit to reach more customers across India. This move signified the brand’s response to the growing demand for on-demand, fast deliveries in the beauty sector.

Highlights From Minimalist on Instamart vs. Blinkit Analysis (September 8–22, 2025)

- Swiggy Instamart has 75 Minimalist products, while Blinkit has 56.

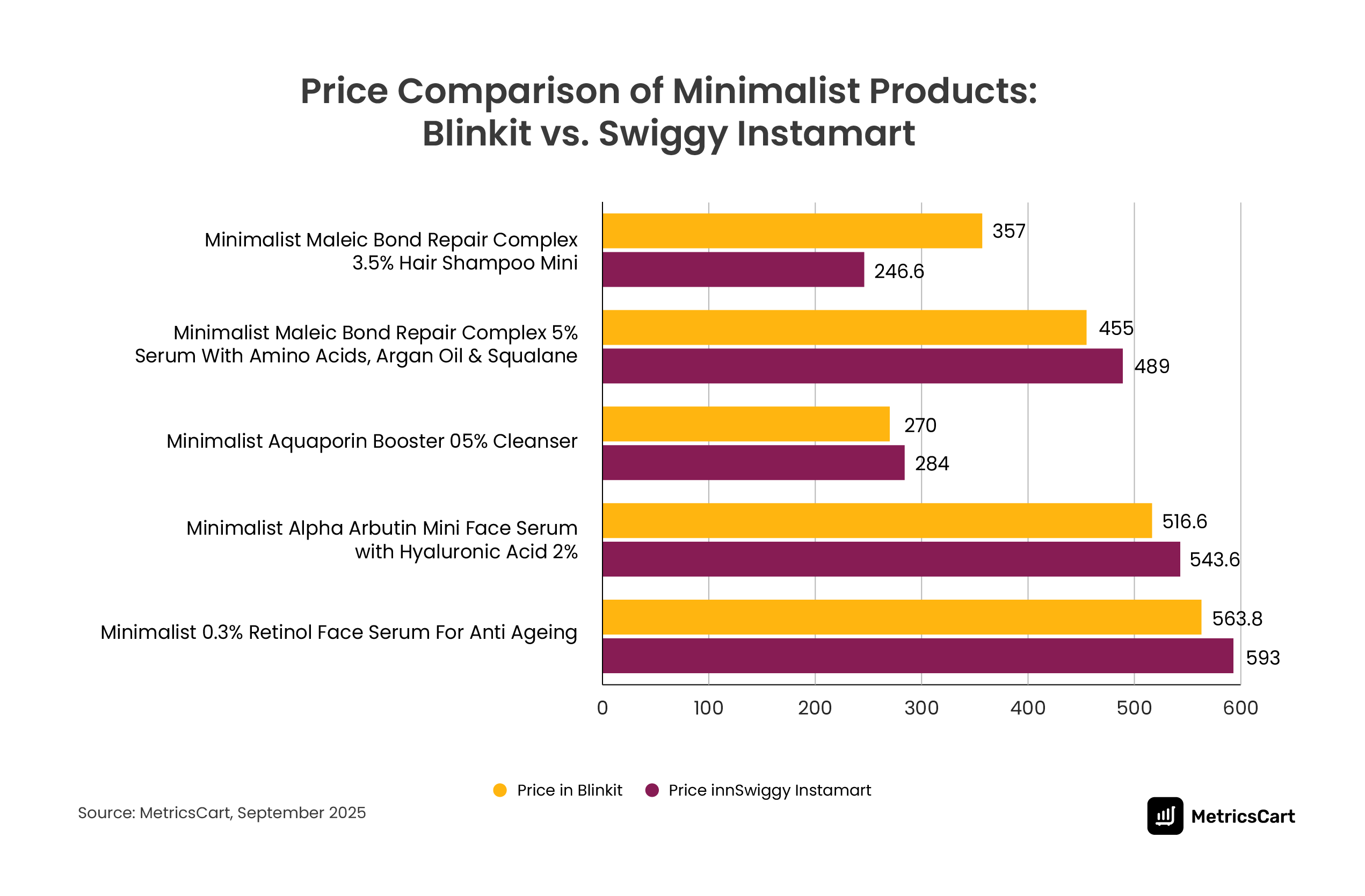

- Minimalist products on Blinkit average ₹443, while on Swiggy Instamart, they average ₹551.96.

- Blinkit’s average delivery time is 12.82 minutes, while Swiggy Instamart takes 20.55 minutes.

- Both platforms offer products below ₹300; Blinkit’s affordable products include Cleanser, while Swiggy Instamart has no specific affordable category.

- Blinkit offers more affordable products on average, with a price difference of around ₹30 per comparable item.

- The most expensive product on Blinkit is the Minimalist Hydrating & Repairing Gift Set (₹900), while on Swiggy Instamart, it is the Minimalist Vitamin C 10% Face Serum (₹974).

- Blinkit offers up to 20% discounts on Skin Care and Hair Care kits, while Swiggy Instamart offers less than 15%, with Serums receiving the highest discounts.

- Face Care products are the top-selling category, with 36 products on Blinkit and 30 on Swiggy Instamart.

Pricing Strategy: Blinkit Is Cheaper Almost Across the Board

Looking at Minimalist product prices on Instamart vs Blinkit, Blinkit consistently offers lower average pricing across categories. The average price of a Minimalist product on Blinkit stands at ₹443, compared to ₹551.96 on Swiggy Instamart. This gap is not limited to a few SKUs. It extends across core skincare, gift packs, and specialty products, positioning Blinkit as the more cost-effective platform for most shoppers.

Specific product comparisons reinforce this trend. The Minimalist Hydrating & Repairing Gift Set is priced at ₹500 on Blinkit, while a similar set on Swiggy Instamart is listed closer to ₹650. Baby Ceramide & Squalane Nourishing Baby Lotion, the second-most expensive product on both platforms, sells for ₹699 on Blinkit versus ₹799 on Swiggy Instamart. A consistent ₹100+ price difference on identical items becomes a meaningful factor for budget-conscious buyers.

From a strategy standpoint, Minimalist’s pricing on Blinkit clearly targets wider mass adoption within the quick-commerce channel. Competitive pricing in highly price-sensitive categories like skincare strengthens conversion at the point of sale and supports long-term brand loyalty, without diluting the brand’s quality positioning.

READ MORE | Why MAP Monitoring is Non-Negotiable for Health and Beauty Brands

Discounts & Promotions: Blinkit Gives Bigger Cuts

When it comes to discounts, the difference between Blinkit and Swiggy Instamart is easy to spot. Blinkit clearly plays more aggressively, using stronger promotions to attract buyers, while Swiggy Instamart keeps its discounts modest and limited.

During the tracked period in Delhi, Blinkit’s discounts went up to nearly 20%, mainly on skincare and haircare kits. Bundled routines and value packs saw the biggest price cuts, which makes sense since these higher-ticket items benefit the most from promotions. Products like daily skincare routine kits and hair care bundles were often discounted by 15–20%, while popular individual items, such as shampoos and serum multipacks, also received 10–14% off. This creates real savings for shoppers, especially for customers buying multiple products or restocking their daily routines.

On the other hand, Swiggy Instamart’s discounts were much more restrained. Most offers stayed close to 10–12%, and very few exceeded that range. These discounts were concentrated mainly on serums and small combo listings, rather than on full routines or larger kits. As a result, shoppers browsing Instamart encounter fewer standout deals and smaller savings overall.

This difference becomes even more noticeable when combined with pricing. Since Blinkit already lists most Minimalist products at lower base prices, the higher discounts further widen the savings gap. Once promotions are applied, shoppers can often see ₹70–₹100 lower final prices per product on Blinkit compared to Swiggy Instamart, particularly when purchasing kits or bundle offers.

From a shopper’s perspective, the impact is straightforward. Blinkit rewards bulk and routine shopping, making it the preferred choice for customers who buy multiple skincare products at a time. Swiggy Instamart’s lighter discounting, while steady, does less to influence purchasing decisions or drive larger baskets.

Category Insights: Face Care Domination in Quick Commerce

The MetricsCart research on Minimalist’s performance across Blinkit and Swiggy Instamart shows that Face Care is the brand’s true volume engine. This category leads not just in sales velocity, but also in repeat purchasing behavior, consistent stock availability, and promotional visibility across both platforms.

Face care SKUs, including serums, sunscreens, moisturizers, and cleansers, dominate shopper baskets because they are tied to daily skincare routines. These products run out faster than specialty or seasonal items, making them natural quick-commerce purchases. Customers aren’t planning large hauls; they’re refilling essentials when they need them, and face care products fit that need perfectly.

Stock data support this demand trend. Face care remains the most consistently “in-stock” category on both Blinkit and Instamart, indicating higher replenishment priority versus other categories such as hair care, baby care, or bundled kits. Platforms keep face-care shelves full because these SKUs deliver the most predictable turnover.

Promotional strategies also center on this category. Blinkit applies stronger discounts on face-care kits and routine bundles to push multi-item purchases and higher checkout values. Swiggy Instamart focuses more on individual face-care serums and smaller combos, though with lighter discounts.

Simply put, face care is the engine of Minimalist’s quick-commerce performance. It delivers the highest sales velocity, the most consistent inventory presence, and the strongest consumer pull across both Blinkit and Swiggy Instamart. For brands operating in fast delivery environments, this confirms that everyday skincare, not specialty kits or fringe categories, sets the pace for success on the digital shelf.

READ MORE | Insights Into the Online Beauty & Personal Care Industry in the US

Blinkit Outperforms Instamart in Delivery Time

Delivery speed is one of the biggest decision drivers in quick commerce, and here, Blinkit clearly holds the advantage over Swiggy Instamart for Minimalist orders across Delhi.

According to MetricsCart findings, Minimalist skincare on Blinkit is consistently delivered in under 12 minutes, particularly across key high-demand zones such as Central Delhi (110005) and South Delhi (110003). This level of speed aligns closely with shopper expectations in quick commerce, where purchases are often impulse-driven or need-based, and delays of even a few extra minutes can influence platform choice.

In contrast, Minimalist skincare on Instamart averages delivery times exceeding 20 minutes for the same pin codes, including 110003 and Central Delhi areas such as 110006. While still quick by traditional e-commerce standards, the longer delivery window puts Instamart at a disadvantage in a category where speed is the core promise.

The gap becomes especially relevant for routine skincare purchases like serums, cleansers, and sunscreens, products that shoppers typically restock at short notice. In these moments, Blinkit’s sub-12-minute delivery creates a clear convenience advantage, positioning it as the more reliable option for urgent replenishment.

READ MORE | Speedy Deliveries: Top Quick Commerce Players in India

Quick Takeaway for Beauty & Personal Care Brands in Quick Commerce

The Minimalist performance across Blinkit and Swiggy Instamart highlights what truly drives success in quick commerce. Winning in this channel isn’t about wide availability alone; it requires getting the fundamentals right at the shelf level, across pricing, promotions, category focus, and delivery execution.

If you’re a brand owner trying to establish or scale your presence in Q-Comm, here are a few points to keep in mind:

- Competitive base pricing drives conversion: lower everyday prices matter more than heavy discounting.

- Targeted promotions work best: bundles and routine kits lift basket size without eroding margins.

- Face care leads volume: daily-use skincare SKUs power repeat demand and stock priority.

- Availability fuels velocity: consistently in-stock products sell faster and build shopper trust.

- Delivery speed closes sales: sub-15-minute fulfillment boosts impulse buys and emergency restocks.

- Platform execution matters: pricing, promotions, and fulfillment quality must work together to win on the digital shelf.

READ MORE | Digital Shelf Insights: Amazon Best Sellers in the Beauty & Personal Care Category

Wrapping the Glow Up

The true success for Minimalist lies in using each platform for what it does best: Blinkit for fast, single-item reorders and Instamart for larger baskets and higher-value sets. The real “Glow Up” comes from treating quick commerce as a data-led channel where speed and assortment stay aligned with shopper demand.

Winning in Q-Comm requires daily execution across pricing accuracy, promotions, stock availability, category focus, and delivery performance.

MetricsCart helps brands manage their product performance in real time, tracking pricing gaps, discount depth, in-stock status, category trends, and delivery speed across platforms. With live digital shelf insights, teams can act faster, protect key SKUs, and improve performance market by market to drive consistent sales outcomes.

Disclaimer: MetricsCart is the exclusive owner of the data used in the Digital Shelf Insights reports. Any kind of third-party usage entails due credit to the source material.

Own the Beauty Shelf on Q-Comm with MetricsCart.