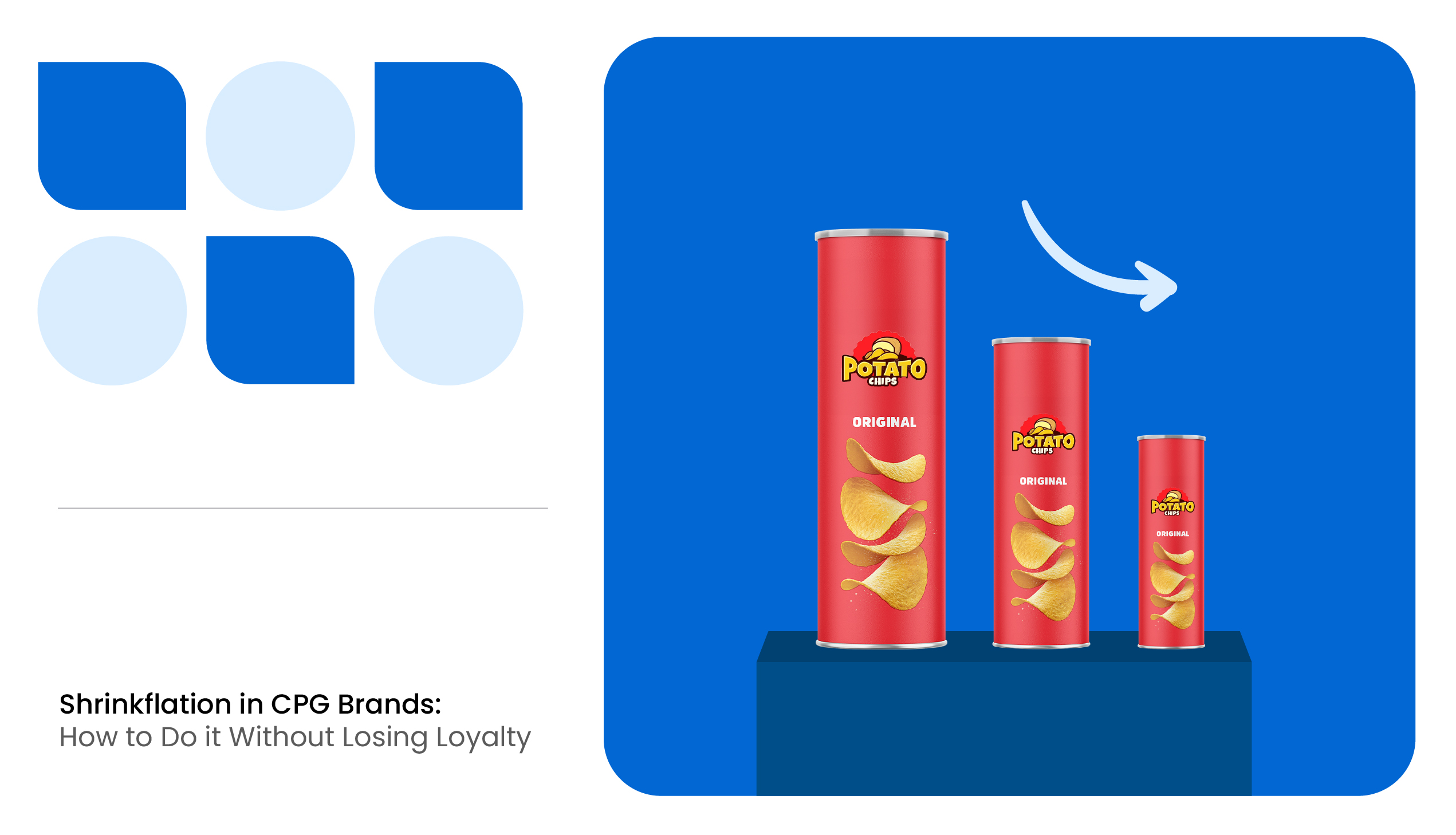

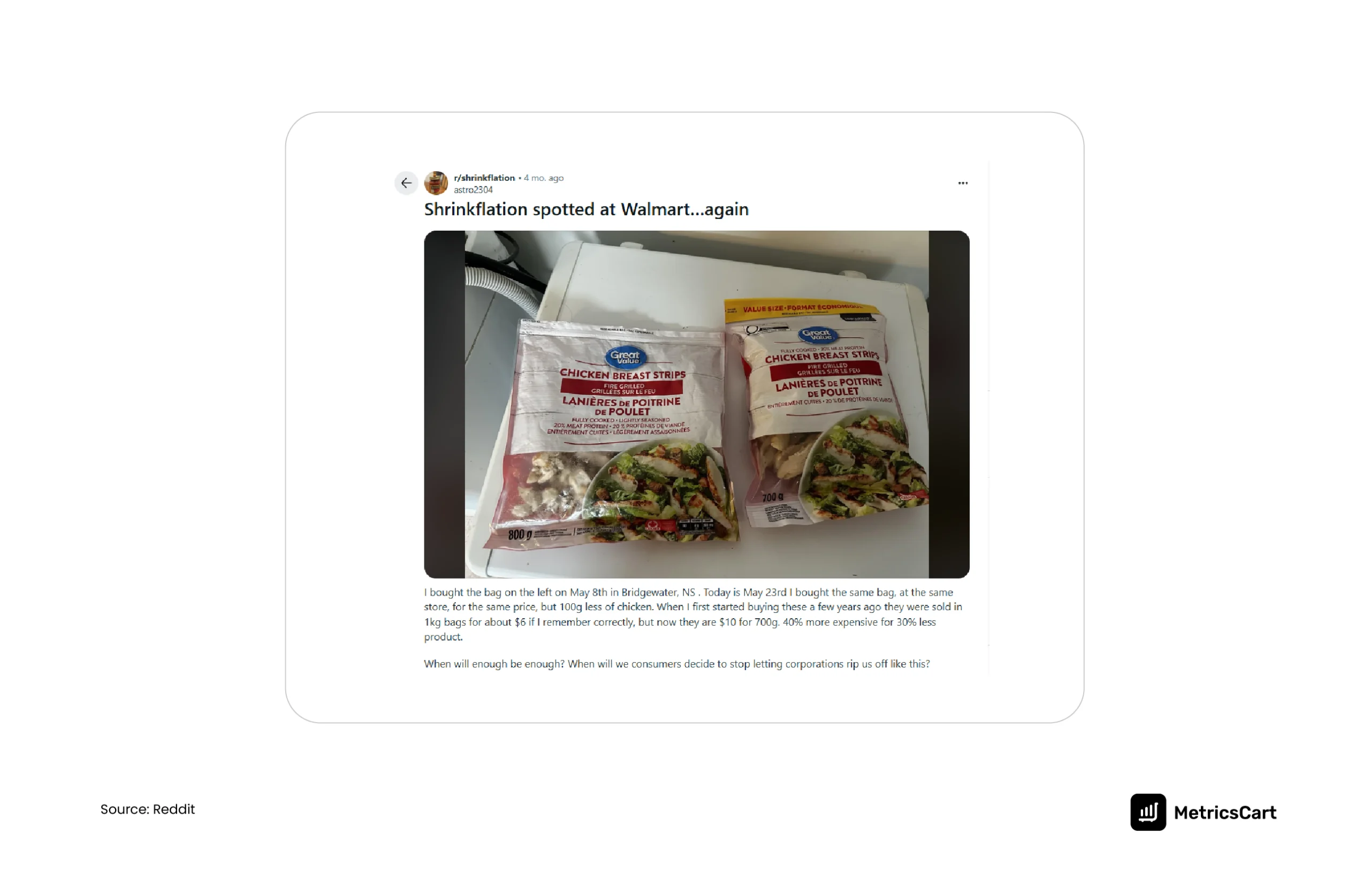

Great Value recently landed in the headlines after a Reddit user pointed out that its chicken pack had quietly lost 100 grams while keeping the same price.

To many consumers, that felt like a sneaky move. In reality, it reflected the growing cost pressures brands face, from raw materials and labor to packaging and logistics, while still trying to keep products affordable.

And this kind of shrinkflation in CPG brands is not an isolated case. According to a LendingTree survey, one-third of products in the US market have already shrunk in size, and 71% US shoppers have noticed it.

In this article, we’ll break down what shrinkflation in CPG brands really means, why companies turn to this strategy, and how they can implement it without harming brand image and customer trust.

What Does Shrinkflation in CPG Brands Mean?

Shrinkflation is the practice of reducing the size, weight, or quantity of a product while keeping its price unchanged. In the Consumer Packaged Goods industry, it can appear in many everyday forms.

Snack packs may contain fewer chips, chocolate bars may become thinner, detergent bottles may hold slightly less liquid, and toilet paper rolls may come with fewer sheets. Sometimes the packaging is redesigned to disguise these changes, such as taller boxes or wider bottles, making the adjustment less noticeable at first glance.

Why Brands Use Shrinkflation

While shrinkflation looks like a greedy practice from the outside, for most CPG brands, it is about survival rather than opportunism.

The costs have been climbing across the board. Ingredients, packaging, logistics, and labor are all becoming increasingly expensive. As per UN Trade and Development research, the freight costs increased 115% from what it was in 2023, and packaging costs are growing at an average rate of 7% each year. For companies selling everyday staples with razor-thin margins, these increases leave little room to operate profitably.

Raising prices outright is the obvious option, but considering shrinkflation vs price increases, brands see the latter as less risky, as nearly half of US consumers are highly price-conscious and quick to switch brands if they notice an uptick in cost.

On the other hand, shrinkflation offers a middle ground. The reduced product size by 5–8% to absorb costs, while keeping the shelf price steady. It isn’t perfect. Consumers eventually notice, and backlash can be sharp. But for many brands, it feels like the lesser evil compared to scaring shoppers away with a higher price tag.

READ MORE | How Consumer Behavior Shaping CPG E-Commerce Growth?

Impact on Consumer Trust

Shrinkflation in CPG brands, although an effective short-term strategy, can do more harm than good to consumer trust if not implemented carefully. Consumers who notice shrinkflation might feel deceived, especially if the changes aren’t apparent on the packaging or communicated properly.

This could lead to a significant loss of customer loyalty, as shoppers might feel that they’re getting less value for their money. Shrinkflation also fuels skepticism about product pricing, with many consumers questioning whether the price is truly justified.

The cumulative effect of poorly executed shrinkflation in CPG brands can lead to a negative perception of the brand. And it’s harder to regain consumer trust once it’s lost.

READ MORE | Good & Gather on Target: How the Retail Giant Nailed Brand Loyalty

6 Best Practices for Implementing Shrinkflation in Consumer Packaged Goods

Shrinkflation is a challenging yet necessary strategy for many CPG brands, but its success depends on how well you execute it. To minimize the risk of losing customer loyalty, here are some best practices brands can adopt:

Transparent Communication with Consumers

Brands should openly disclose any changes in product size or pricing, possibly disclosing the reason behind the change. It is essential to maintain consumer trust and encourage fair market practices.

A prime example of this is Carrefour, a leading French supermarket chain, which has introduced shrinkflation warning labels on products that have reduced in size while increasing in price.

By clearly communicating these reductions, Carrefour enables consumers to make informed purchasing decisions and holds manufacturers accountable for their pricing practices. This transparency helps them build trust with customers and demonstrates a commitment to fairness.

For CPG brands, adopting similar transparency can help prevent negative consumer reactions, ensuring their customers are retained despite shrinking product sizes.

Maintain High Product Quality

Even if a product is slightly smaller, maintaining its perceived quality is crucial to prevent alienating loyal customers. If consumers notice that a favorite product feels “cheaper” or less satisfying, shrinkflation can backfire.

Here are some tips for maintaining quality:

- Focus on core attributes: For example, if it’s a chocolate bar, the taste and texture should remain unchanged even if the weight drops slightly. Consumers are more forgiving of smaller sizes if the experience is consistent.

- Use premium ingredients strategically: Some brands reduce quantity but improve the quality of ingredients or packaging to maintain a sense of value.

- Test changes with loyal customers: Before rolling out a new, smaller pack nationwide, pilot it with a select group to see if the quality perception remains intact.

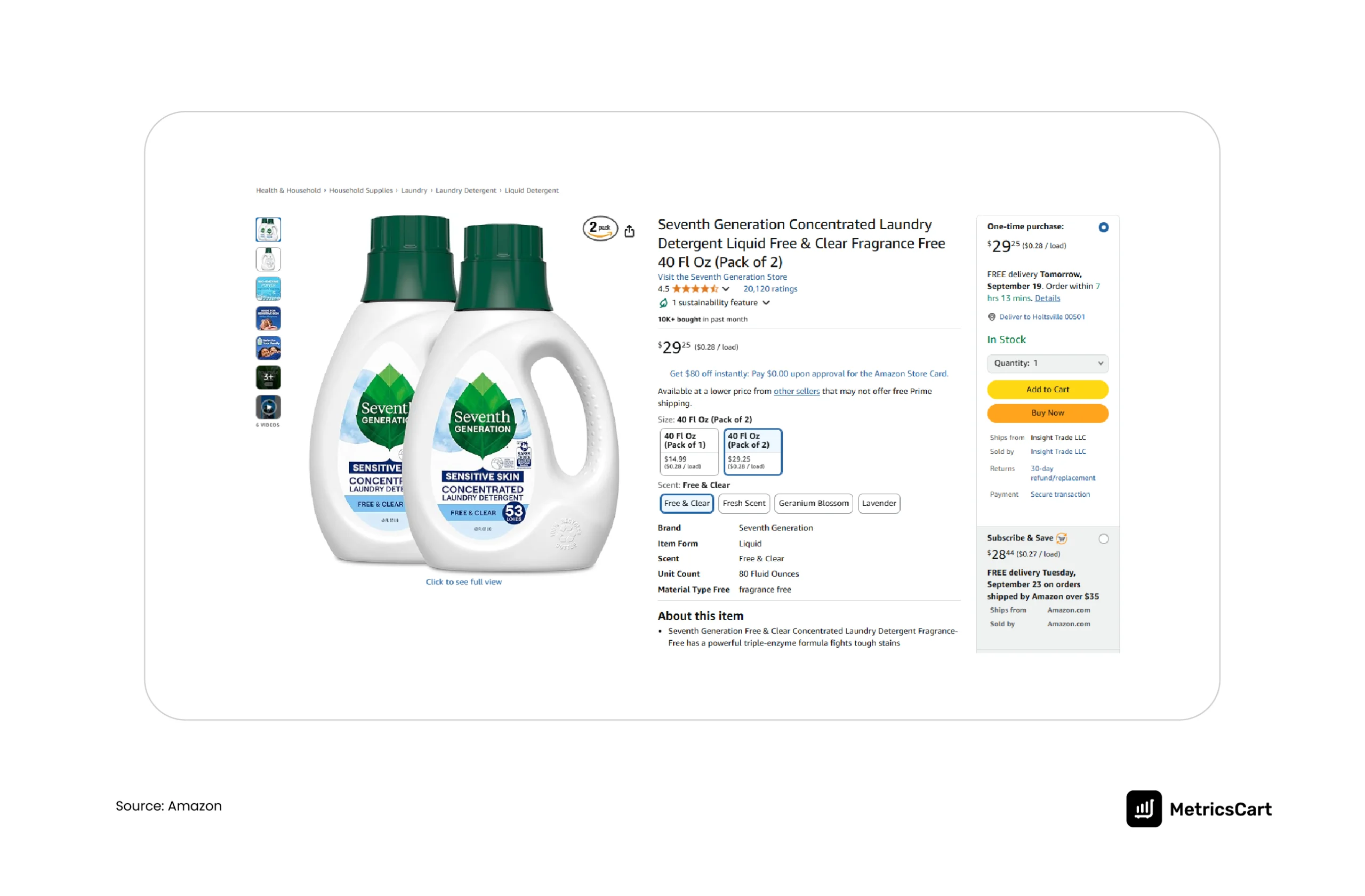

Use Value-Added Packaging or Bundles

Value-added packaging and bundle offers are a smart way to mitigate the impact of shrinkflation.

When brands reduce the size or quantity of a product, bundling products together or offering larger packaging can make consumers feel they are still getting a better deal. This approach can provide customers with more perceived value, softening the blow of shrinkflation

For example, instead of reducing the size of a detergent bottle and raising the price, a brand can offer a multi-pack or a larger container that offers better value per unit. This makes consumers feel that, despite the smaller individual size, they’re still receiving a good deal overall.

READ MORE | All About Amazon Virtual Bundle Explained with Example

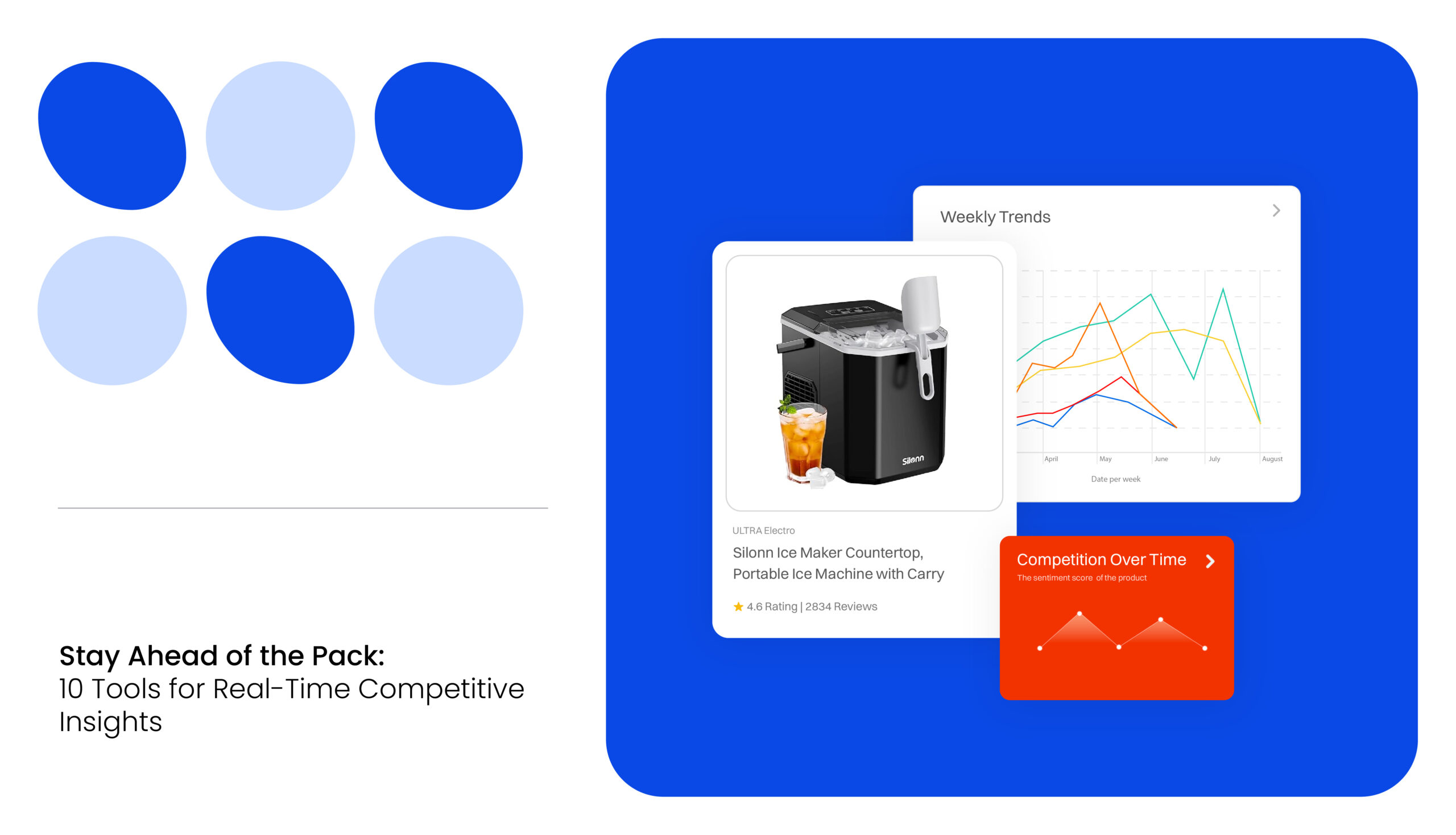

Monitor Competitor Pricing and Positioning

Shrinkflation doesn’t happen in isolation. How your competitors price and package their products also directly affects consumer perception of your brand. So, carefully track the market to ensure that any reduction in size or quantity doesn’t make your product appear less valuable compared to alternatives.

Regularly compare your product sizes, prices, and promotions to similar offerings in the market. This ensures your products remain competitively positioned. When you notice your product is slightly smaller, emphasize what sets it apart, such as premium quality, unique flavors, or added benefits. Marketing can turn shrinkflation into a narrative of value rather than loss.

Leverage Customer Loyalty Programs

Customer loyalty programs are an effective way to counter the negative effects of shrinkflation or price increases. These programs offer consumers rewards, discounts, or personalized benefits, which help maintain their loyalty even when product sizes shrink or prices rise.

For instance, while Starbucks doesn’t directly implement shrinkflation in the traditional sense, the brand has been able to mitigate negative consumer reactions to price hikes through its loyalty program.

When prices increase due to inflationary pressures, Starbucks uses its rewards program to offer customers personalized discounts, free drinks, or bonus points. This keeps consumers feeling appreciated, even when the product price increases or product sizes decrease.

Regularly Collect and Act on Customer Feedback

Customer feedback is a critical tool for managing shrinkflation without harming loyalty. When shoppers notice changes in product size, quality, or pricing, their reactions can quickly shape the brand’s reputation. Brands that actively monitor and respond to this feedback can prevent minor dissatisfaction from turning into widespread backlash.

Best practices include:

- Track mentions of your product on platforms like Reddit, Twitter, and review sites to catch early signs of consumer frustration.

- Conduct surveys and directly ask loyal customers about their perceptions of product changes to gauge potential risks.

- Use feedback to make real improvements, whether that’s adjusting product size, quality, or communication strategies.

PepsiCo faced backlash when customers noticed smaller bags of Tostitos and Ruffles. Rather than ignoring the complaints, the brand responded by adding 20% more chips to select bags at no extra cost. This swift response, prompted by consumer feedback on social media, helped restore trust and showed that PepsiCo valued customer opinions.

By regularly collecting and acting on feedback, brands can turn shrinkflation into an opportunity to demonstrate responsiveness, reinforcing loyalty even amid cost pressures.

READ MORE | Benefits of Customer Feedback Tracking: Everything You Need to Know

The Future of Shrinkflation for CPG Brands

Shrinkflation is a necessary yet delicate strategy for CPG brands facing rising costs and supply chain challenges. The difference between success and backlash lies in execution.

Looking ahead to the future of shrinkflation for CPG brands, those that prioritize transparency, maintain product quality, add value through packaging or bundles, leverage loyalty programs, and actively collect customer feedback are more likely to preserve trust and loyalty.

Tools like MetricsCart can further strengthen these efforts by enabling brands to monitor competitor pricing, product availability, and market trends in real-time, ensuring data-driven decisions and competitive positioning.

By combining thoughtful shrinkflation strategies with proactive engagement and real-time insights, CPG brands can manage costs while keeping consumers happy and loyal.

Monitor the Performance of Your Resized Products.

FAQs

Yes, shrinkflation continues to happen as long as inflation, rising tariffs, and supply chain disruptions persist. Many CPG brands are still using this strategy to manage rising costs while keeping products accessible to price-sensitive consumers.

Common examples of products that have used shrinkflation include snack foods, toilet paper, laundry detergent, and chocolate bars. These items are often reduced in size or weight, while prices remain the same or only increase slightly.

Shrinkflation involves reducing the size or quantity of a product while keeping the price the same, whereas a price increase raises the cost of the same quantity of a product. Brands may choose shrinkflation over price hikes to avoid losing price-sensitive customers.

Yes, shrinkflation is legal as long as the product size change is accurately reflected on the packaging, and the price remains in line with consumer expectations. However, brands need to be transparent about the changes to avoid consumer backlash.