Groceries, real estate, airfares, cars, fuel – you name it – everything seems to be expensive now. But why?

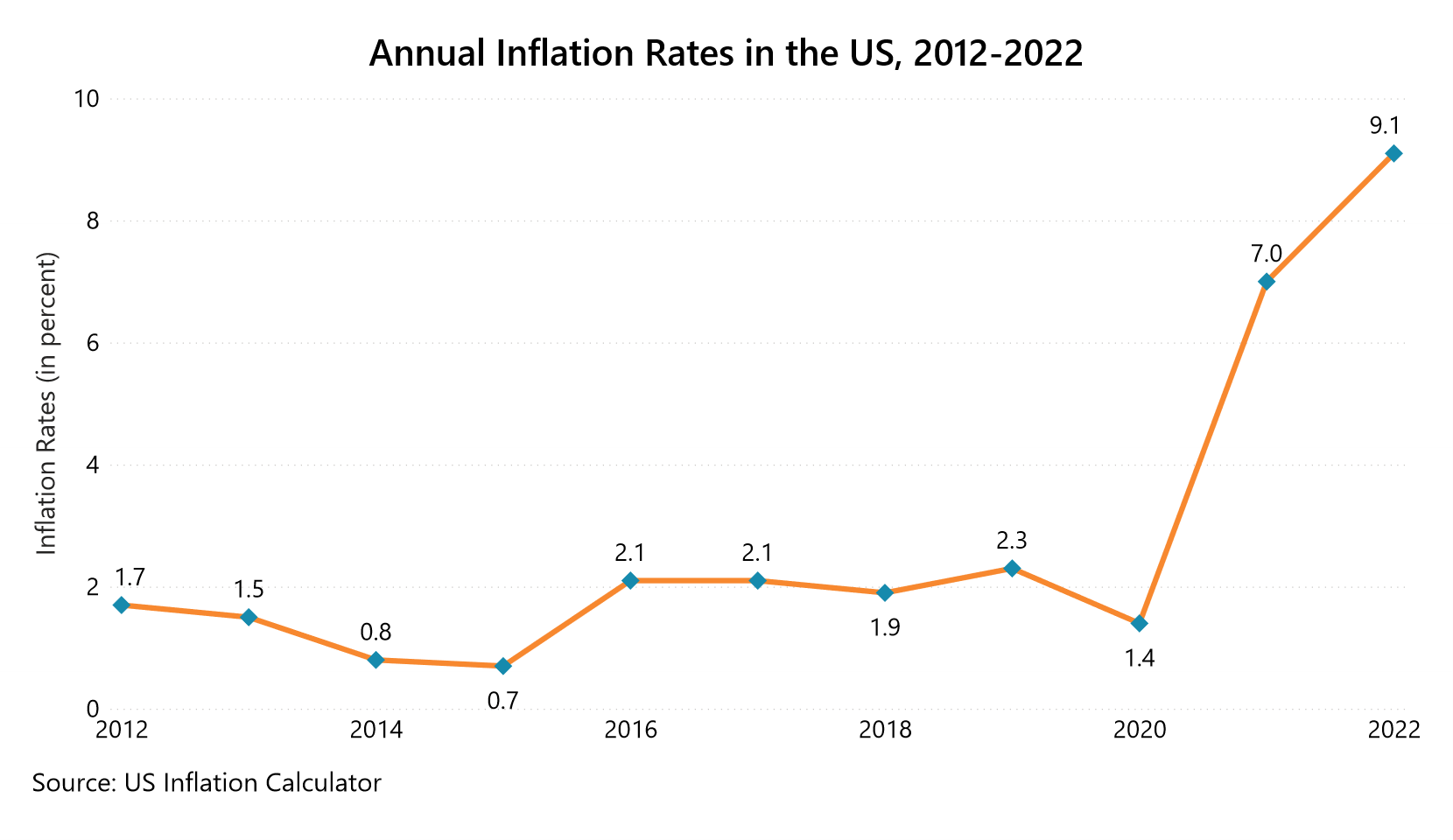

Inflation is a term used all over the media these days. The US economy is dealing with a pressing inflation challenge in 2022. In fact, the retail inflation shot up to the hottest year-over-year 9.1% annual rate in June. This set a record of 41-year high inflation.

[table_of_contents numbered=true]

What Exactly is Retail Inflation?

Back to the Basics

Retail inflation (also known as consumer price index inflation) is the continual rise in the general prices of goods and services that we consume in our day-to-day lives. Inflation, in itself, is linked to the pricing of goods and services.

The US is now experiencing cost-push inflation. In such a case, the prices of raw materials go up, i.e. the cost of production increases for retail businesses or the wage rates for labor goes up. Retail businesses end up setting higher prices for their products, which are ultimately paid by the consumer.

How is Inflation Measured?

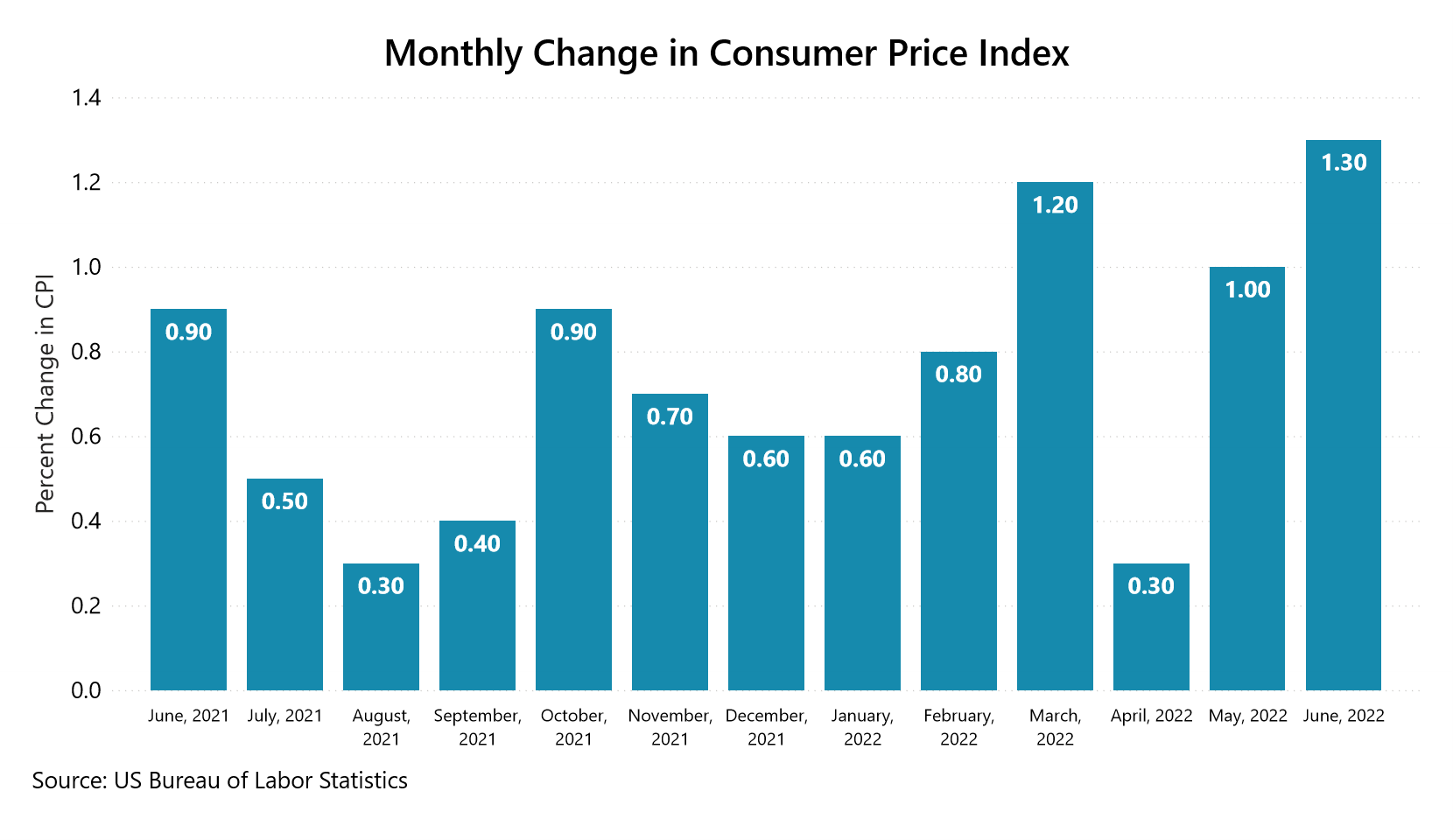

The Consumer Price Index (CPI) is used to calculate the US retail inflation. CPI is defined as a measure of the average change in the prices of a basket of consumer goods and services paid by urban consumers over a period.

The retail sales slowed down in the month of June as the CPI rose by 1.3%. The largest contributors were the indexes for – shelter, motor vehicle insurance, used cars and trucks, new vehicles, medical care, household furnishings and operations, recreation, and apparel.

Headwinds for the US Economy

The demand for goods drove up during the pandemic. One of the prime reasons for the demand to shoot up was the pandemic-relief packages offered to the public. The US government spent nearly $5.3 trillion on relief packages since January 2020. This contributed to 3 percentage points increase in inflation until the end of 2021, according to a recent study by the Federal Reserve Bank of San Francisco.

The increased demand put the supply chain of the country in a difficult position. The supply challenges in the US account for half of the surge in inflation.

Moreover, oil prices have been at a high rate since the pandemic. Two years ago, the prices were less than $2 per MCF. Now it is about $7 per MCF. This has increased the cost of producing and transporting goods.

Severe storms and drought-hurt harvests have resulted in higher food prices.

Inflation further worsened with the ongoing Russian-Ukraine conflict as it interrupted international trade flows, increased the cost of oil and gas, and disrupted food supply.

However…

Around two out of three US retailers enjoyed higher profit margins due to inflation.

As discussed earlier, retailers primarily deal with inflation by increasing the input costs, from production to sales. This assures them of better profitability.

On the flip side, consumers are overwhelmed by how inflation is pushing the prices up for most goods and services. This is particularly true in the lower-income bracket.

To bring retail inflation under control, the Federal Reserve, the nation’s central bank, recently increased interest rates and has signaled multiple future rate hikes. This, in turn, will make borrowing expensive for the consumer and reduce their spending. Retailers, however, are on the other side of the story.

Let’s see how this inflation has affected the retail industry.

Inflation in Retail

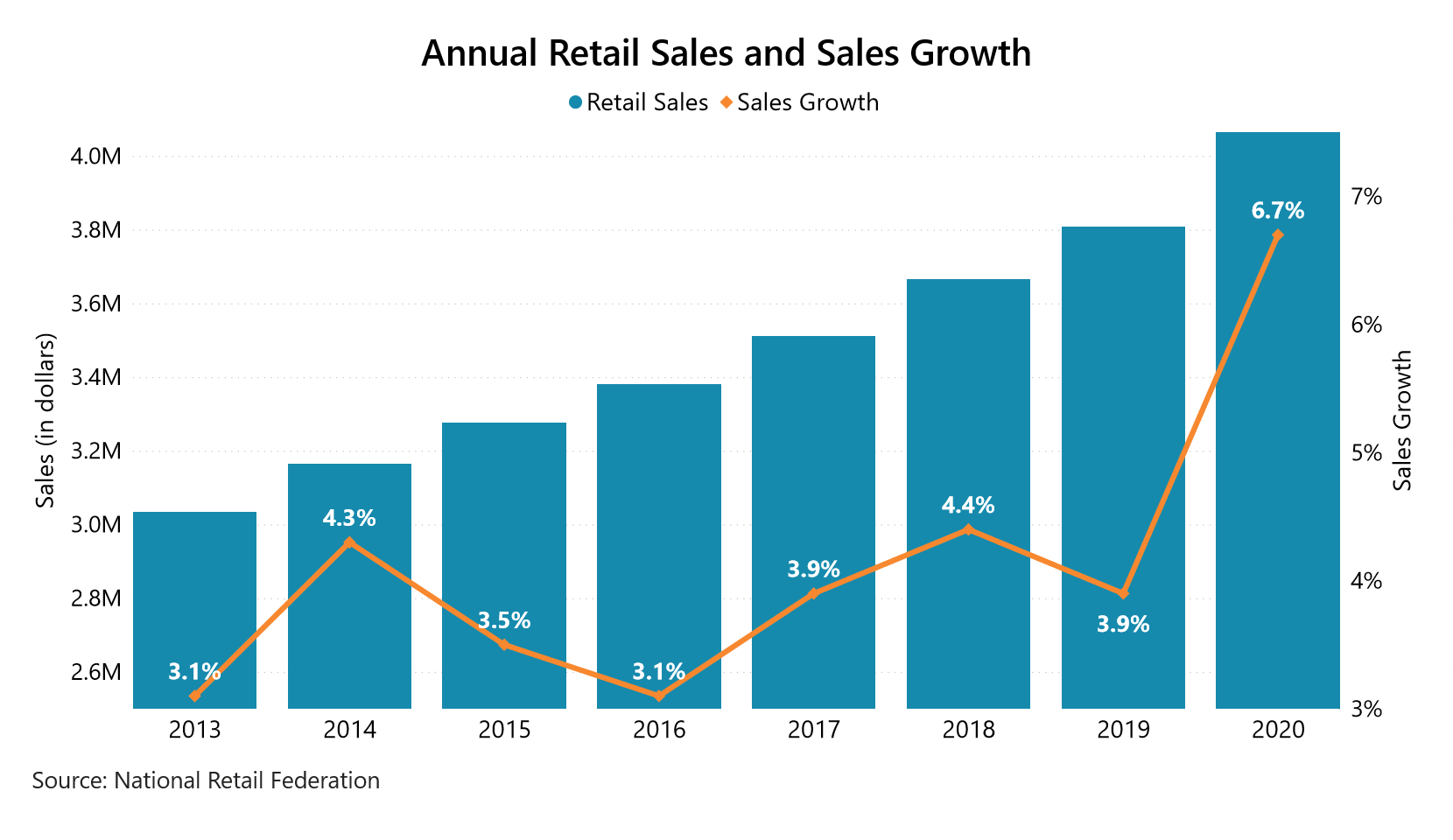

The US retail sales grew by 14% in 2021 when compared to 6.7% in 2020. In 2021, consumer spending increased throughout the year. Amazon, Costco and budget-friendly mass retailers such as Walmart Inc. emerged as clear winners.

One-third of Americans in the higher income brackets spent two-thirds of this spending. However, inflation did not stop consumers from spending even in the early months of 2022. The US consumers spent 18% more in March 2022 when compared to two years ago.

Also read: Amazon Prime Day Sales in the US, 2022

Nonetheless, retail inflation will affect consumer behavior, especially now given that it is at a 41-year high. This will also force retailers to balance near-term challenges with long-term commitments and revolutionary thinking.

Let’s find out what steps retailers in the US are already taking to ensure better profitability and stability during these uncertain times.

10 Ways Retailers are Tackling Inflation in 2022

Inflation is often deemed to be a bad thing, but it is always present. It forces retailers to make certain choices on how to best manage their business. Let’s dive deeper into the current reality of retailers and how they are coping with retail inflation.

Retailers are setting higher prices due to inflationary cost pressures

Retailers often need to deal with inflationary cost pressures. This can be the cost of production, shipping costs, wage rates, and much more. To keep up with the cost, they resort to raising prices. The shelf prices for goods consumers see in physical and online stores become the key measure of consumer price inflation.

To fix the rising costs in times of inflation, national brands are introducing a product line with economy pricing. Retailers are countering this problem by introducing private labels or no-label products.

Moreover, retailers sometimes deploy the pocket price waterfall approach while offering discounts to consumers. This is a discount management strategy to differentiate between profitable and unprofitable customers. Using this approach, retailers create discounting guidelines, diagnose challenges, and provide solutions in terms of more strict control, especially of off-invoice discounts.

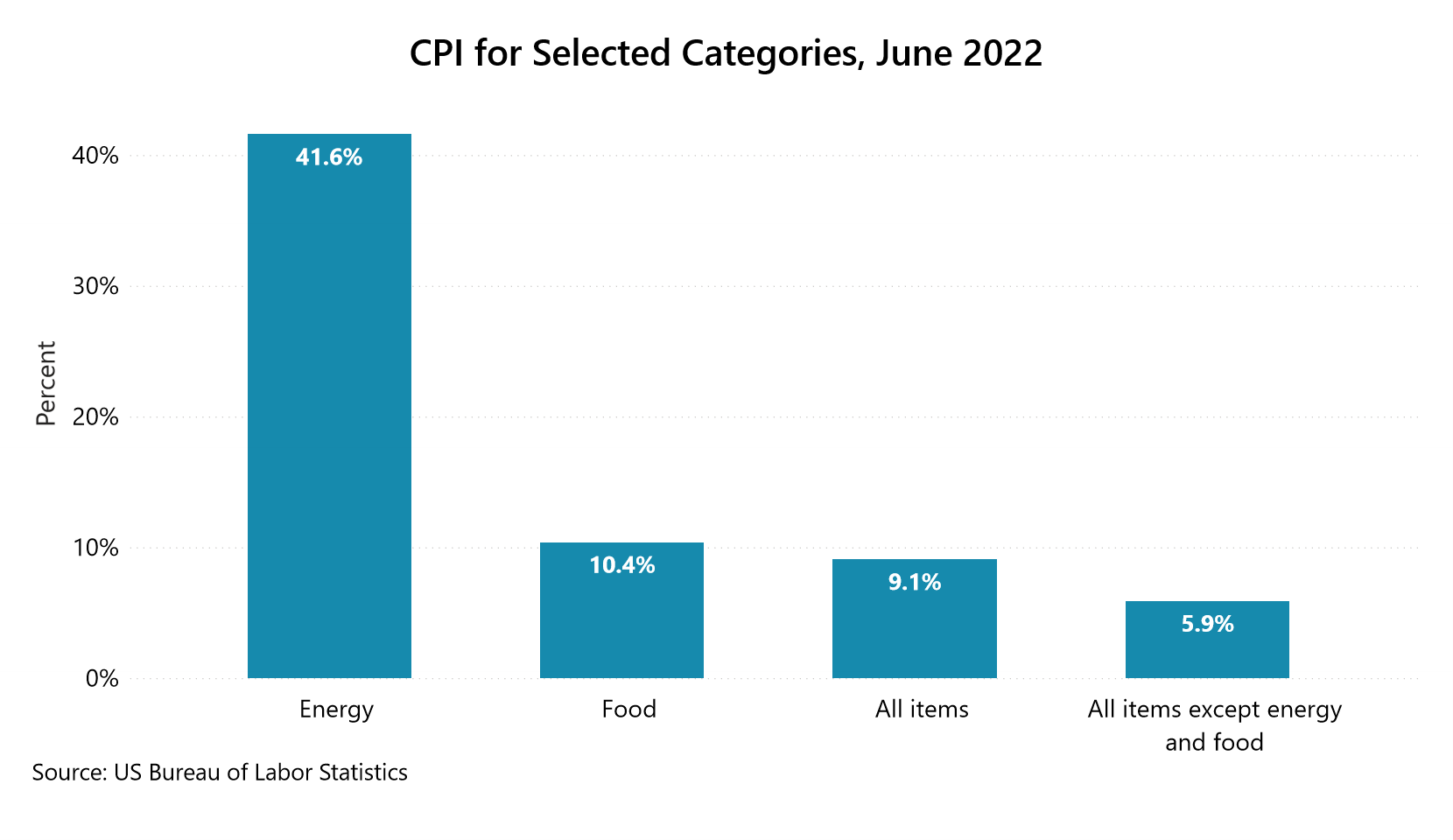

In the chart below, please note that “All Items Except Food & Energy” is the total price paid by urban consumers for a basket of goods, excluding food and energy. This measurement is known as Core CPI. Economists widely use this measurement, as food and energy have volatile prices.

The 9.1% annual increase in CPI is for All Urban Consumers (CPI-U). The CPI for Urban Wage Earners and Clerical Workers (CPI-W) increased by 9.8%. The Chained CPI for all Urban Consumers (C-CPI-U) increased by 8.4% (all the indexes are subject to revision).

As of June, food prices shot up 10.4% year over year. Prices for groceries rose 11.9%, far outpacing the 7.4% at restaurants and takeout. Many Food and Beverage (F&B) companies, including Campbell Soup Co., Kellogg’s, Kraft Heinz, and others, raised their prices recently.

Also Read: Prestige Pricing: 10 Examples of Brands Scaling Their Pricing Strategy

Retailers are reviewing new shopping patterns of their customers

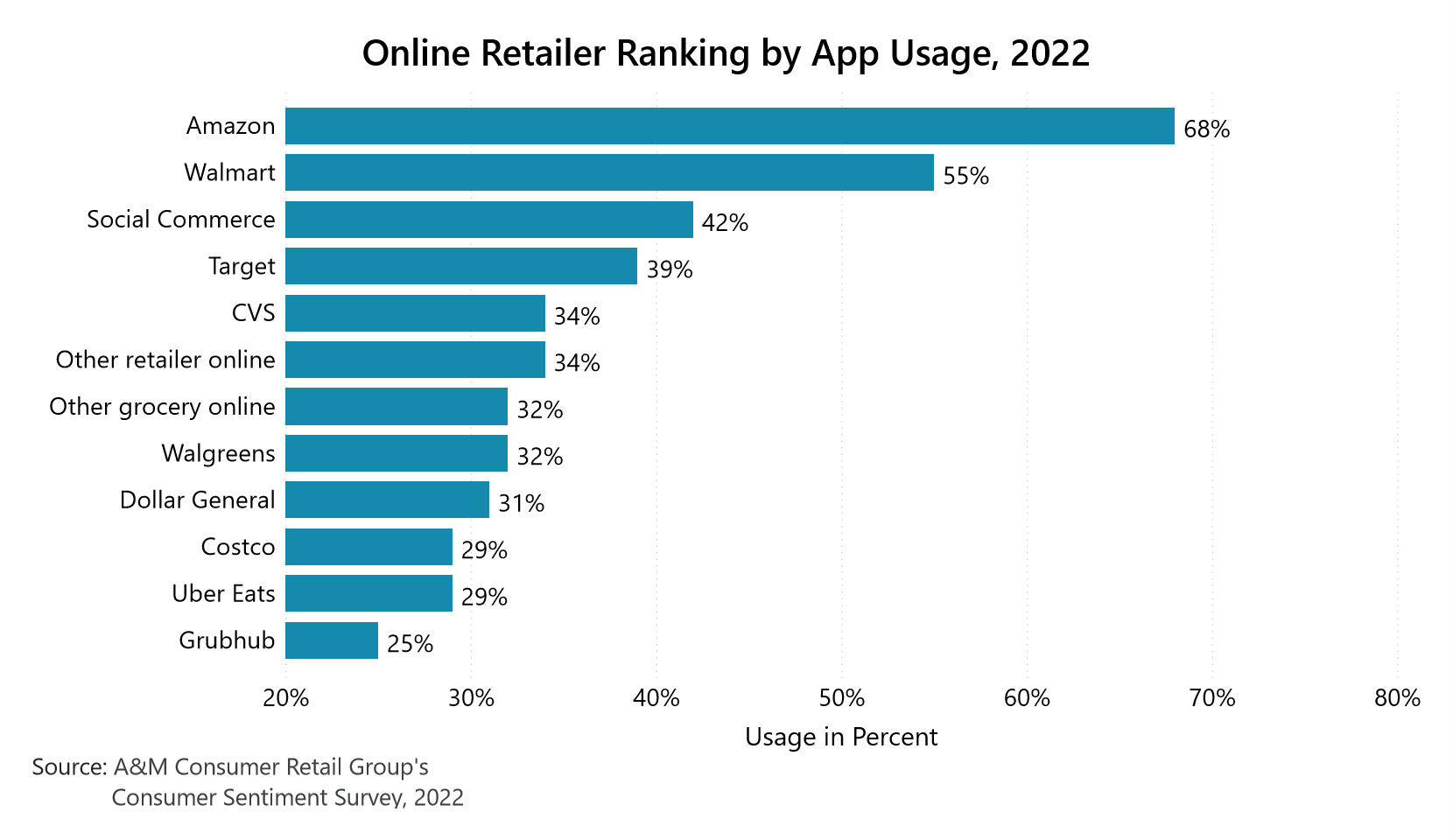

A survey conducted by A&M Consumer and Retail Group in February and March 2022 showed that 80% of consumers have stuck with pandemic-driven changes in shopping behavior. Their increased focus is to spend on basic needs and experiences. 59% of them only shop when there is something they really need. They are even switching to cheaper store brands lately.

Shoppers have come to depend on mobile apps mostly to help them with everything from finding deals and coupons to tracking budgets and creating shopping lists. Amazon is the most sought-after app among consumers. Its monthly and weekly app accounts for 68%. This is followed by Walmart (55%) and shopping via social media (42%).

Amidst the US retail inflation, a cross-shopping pattern is another trend lately. By diving into cross-shopping patterns, retailers identify products they are missing or products that are not marketed, displayed, or priced effectively. This helps retailers gain a deeper view of the competitive landscape and pinpoint their strengths and weaknesses around specific categories.

Walmart customers’ cross-shopping with five other discount retailers – Big Lots, Family Dollar, Dollar Tree, Dollar General, and Five Below – between the first quarter of 2021 and the fourth quarter of 2021 shows a gradual quarterly increase in the share of Walmart shoppers who also shopped at the other discount retailers.

Retailers are considering inventory management as a crucial factor

In times of rising prices, managing inventory help businesses tackle inflation. Inventory investment is also seen as a cost-effective method to prevent supply chain disruptions. One of the common challenges retailers face during strong inflation is excess inventory.

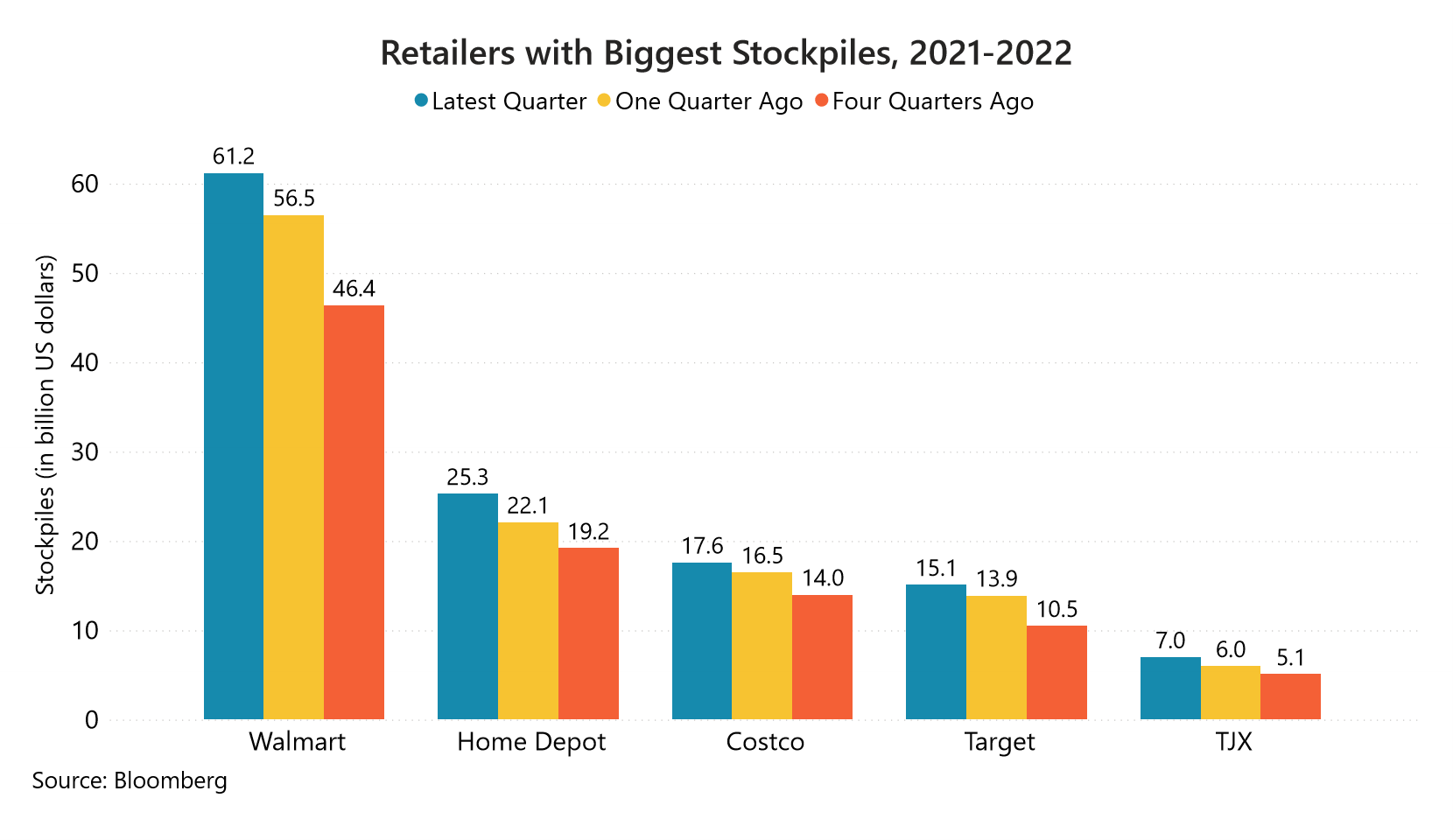

In the US, some of the biggest retailers recorded nearly $44.8 billion in excess stock. Though the average basket size of shoppers has increased, the items per basket have only reduced as the cost per item has shot up.

Companies now realize inflation is a more permanent feature of the economic landscape. Negotiating long-term contracts with suppliers, buying local and pricing goods to maximize profits are some other ways retailers are managing inventory. In May, Walmart, Home Depot, Costco, Target and many other retailers experienced inventory buildup and the need to reduce the prices of goods.

Retailers are reconsidering and reviewing their product mix

By bundling or unbundling existing products, retailers create new value propositions and even expose customers to lower price points. This helps them steer customers toward profitable offerings.

As discussed earlier, food prices shot up by 10.4% over the past year. This is the biggest annual jump reported since 1981. Unfortunately, rising prices weren’t enough. Many products now have lesser quantities. Kleenex recently reduced the number of tissues in a box from 65 to 60, retaining the same price point. Domino’s Pizza is shifting from 10-piece chicken wing to-go orders to 8 for the same $7.99. This is a classic case of what’s called shrinkflation.

When thinking about inflation, price sensitivity is often highlighted as the key factor in determining how customers will respond to any changes. But customers are also quantity and quality-sensitive.

To make sure the customers’ needs are met, retailers identify the Key Value Items (KVIs). KVIs are essentially the products consumers often compare prices before buying. Focusing on them during economic uncertainty, retail businesses ensure everyday price competitiveness.

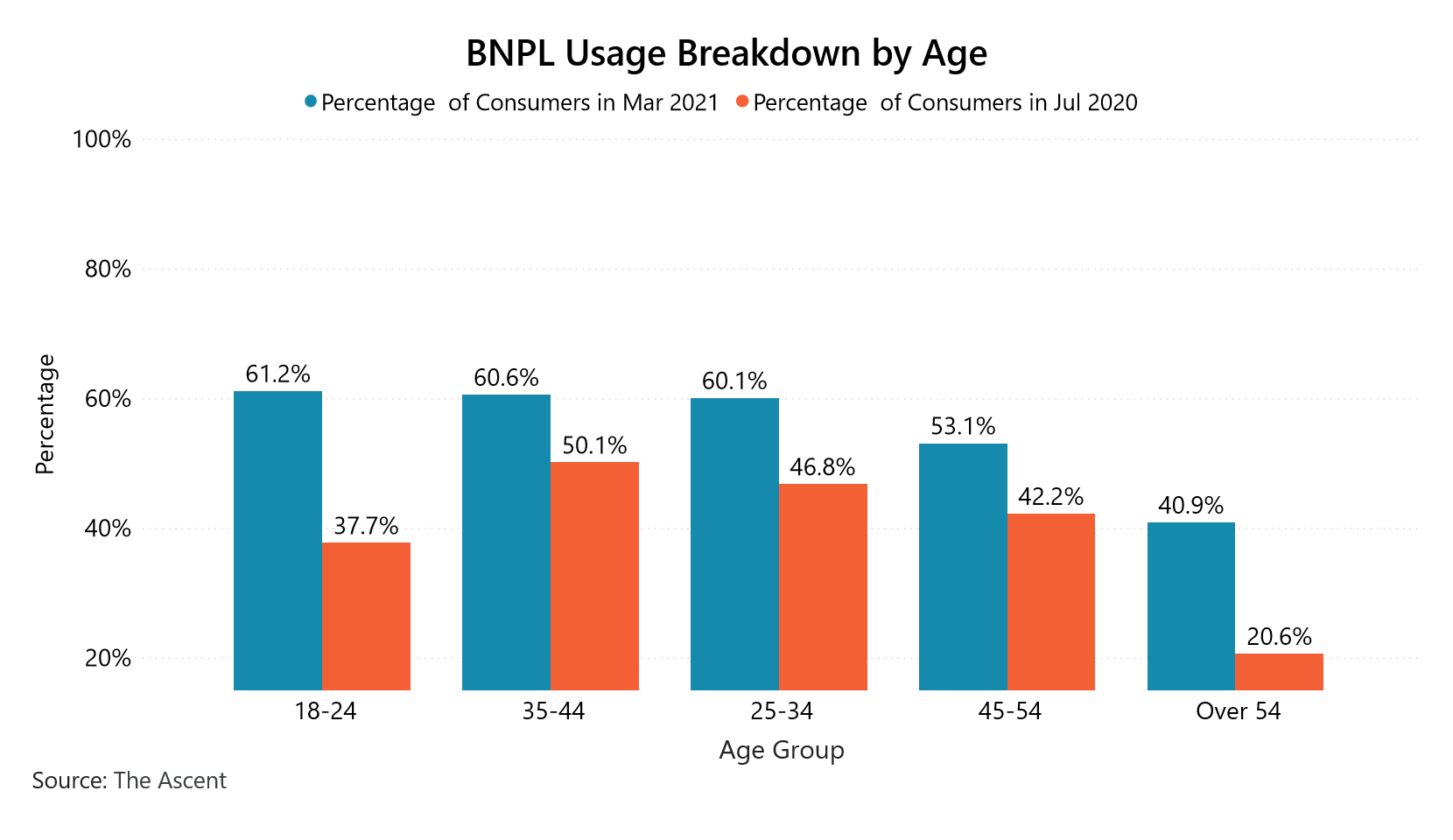

Retailers are relying on Buy Now, Pay Later (BNPL) services

All of us are familiar with the Buy Now, Pay Later (BNPL) feature commonly available on most online retailer platforms when we shop. It offers interest-free payment in installments for consumers. Popular retailers such as Calvin Klein, Reebok, and Bloomingdale’s have added this payment option.

In 2021, 56% of Americans had used a BNPL service. The services vary from provider to provider. This flexible mode of payment comes with no interest or service charges. It, in turn, adds to consumers’ convenience when the prices of everything are currently on a rise. Afterpay, Sezzle, Affirm, and PayPal Pay are some of the popular BNPL service providers.

Private label brands are gaining importance in retail with inflation around

Consumers purchasing private label products is a growing trend during this inflation. A private label product is one that a retailer produces with the help of a third party and sells under its own brand name. Consumers are usually willing to try new brands or explore cheaper alternatives to recognized brands during inflation. Even in 2008, American households turned to private label brands when the economy was undergoing a recession.

Read more: Understanding the Potential of Private Label Brands

Despite the inflation, Target is benefitting from the situation, as the retailer’s in-house brand is much cheaper than products with better name recognition. So is the case with Walmart. Walmart’s Great Value dish soap costs only $2.28. On the other hand, Procter & Gamble’s Dawn dish soap costs $2.94. In March, Kroger reported a record 13.6% year-over-year increase for its store brands.

Retailers are looking at other sources of revenue

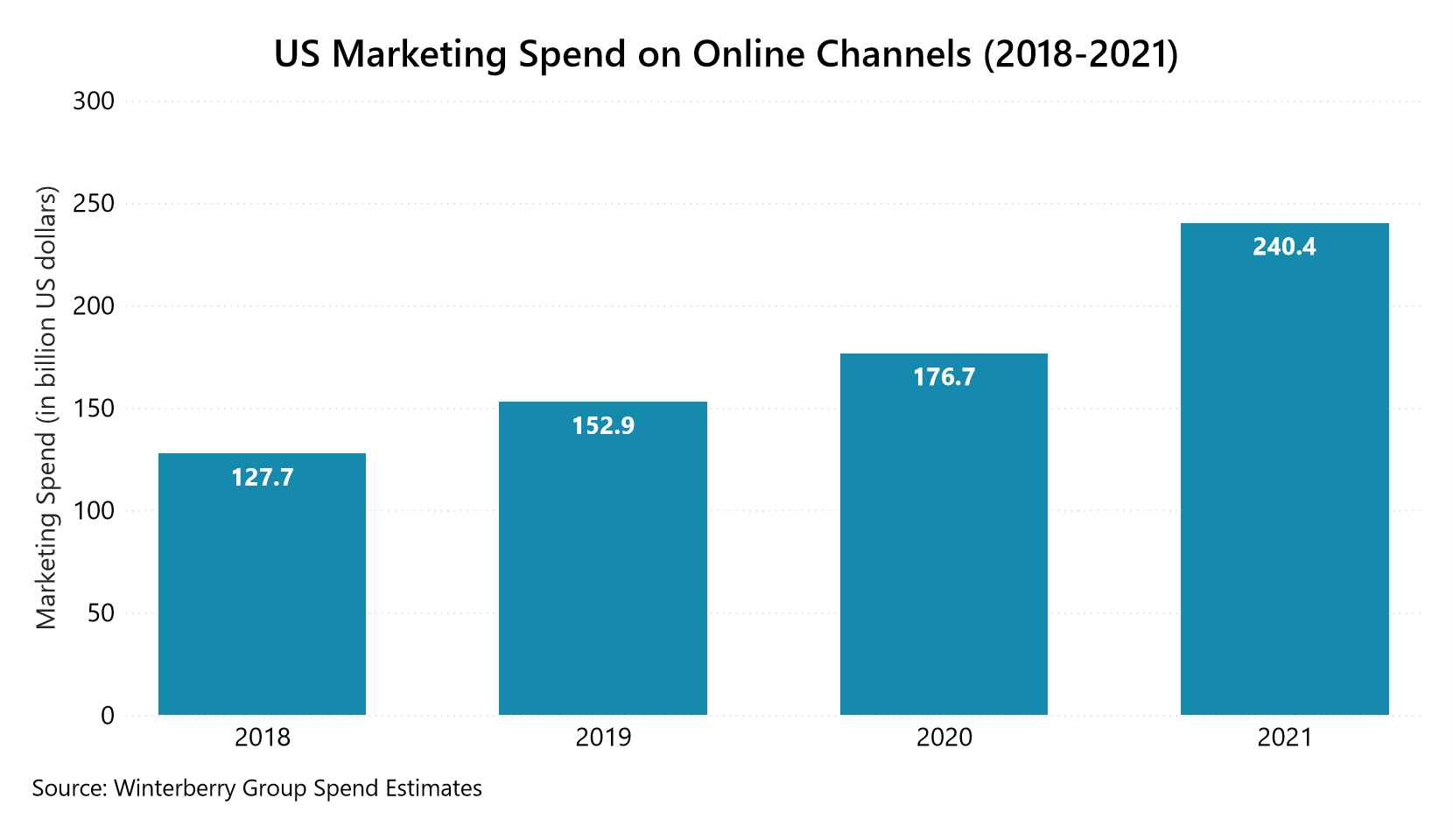

Retailers are exploring new profit streams with rising inflation and supply chain costs. For one, retail media networks are aggressively expanding. In 2021, retailer media saw 47% growth. Brands, including Walmart, Target, Kroger, and CVS, have quickly built out media networks. This helps them tap into their in-store and online shopper data.

New sources of revenue from organic growth through digital advertising and shifts from traditional channels are accelerating retail media businesses. According to a recent report from Winterberry Group, $240 billion was spent on online advertising and marketing in the US in 2021. Interestingly, Amazon accounts for 89% of the total retail media ad spend in the country.

However, battling inflation doesn’t need to be a solo affair. Collaborations and partnerships are also other sources of revenue. Notable recent partner ecosystems include Kroger with Bed Bath & Beyond, Target with Ulta Beauty, Hy-Vee with DSW shoes, H-E-B with James Avery Artisan Jewelry, and Morrisons with Amazon.

Retailers are using technology to get the better of inflation

Technology has significantly developed in the “new normal.” With strong inflation, retailers are turning to technology and data to reach and engage with target customers. Cashier-less and partially automated Amazon Go stores are one of them. Customers can shop products at a store by using a self-checkout station. Smart shelving is another technique where retailers use AI-powered technology to track and update inventory for products on their website and avoid a situation of customer frustration.

Phygital retail has been picking up ever since the pandemic. Blurring the lines between physical and digital stores via omnichannel marketing is here to stay. To implement this, retailers are also investing in data management solutions to get actionable insights. Digital Shelf Analytics (DSA) helps the world’s biggest brands to reach customers, clear out inventory, reduce out-of-stock instances and lower discounting.

Brands and retailers are now actively using first-party data to target customers amidst inflation

Brands and retailers are leveraging first-party data – data that is created when the customer directly interacts with the brand. This includes data on customer sentiment, app engagement level, product issues, in-app purchases, and a lot more.

Each engagement becomes a valuable piece of actionable data, such as loyalty programs, membership sign-ups, and registration benefits. Bolstering marketing programs with coupons and loyalty rewards are a big win-win right now. This allows brands to cater to their customers with more customized experiences.

Interestingly, this also raises many questions. How do retailers put such first-party data to their best use? Where can one gather this form of reliable data? Where can one monitor the competitors’ product offerings? A robust Digital Shelf Analytics (DSA) solution might be the answer.

Retailers are Investing in Digital Shelf Analytics (DSA) to Monitor the Competitor Landscape

According to a research study by Boston Consulting Group with Google, advanced analytics can increase sales growth for consumer packaged goods companies by over 10%. Out of which, 5% directly comes from marketing.

Retailers with a growing trade presence are already deploying a digital-first approach. Tracking KPIs such as inventory availability & assortment, price changes, product performances, ratings & reviews, and more have become crucial for a retailer’s online growth. To facilitate this, retailers are investing in advanced Digital Shelf Analytics (DSA) solutions to gain competitive data during this period of inflation.

With millions of Americans struggling to make ends meet, curbing retail inflation has become the need of the hour. The issue is not unique to the US economy alone. Several other global economies are going through a similar situation. And more often than before, retailers end up reinventing their businesses in order to sustain and grow.

At MetricsCart, we provide actionable insights via our digital shelf analytics solution. Reach out to us now to set your business up for success.