Not long ago, a disturbing video went viral on X, showing a Bengaluru family pouring Hershey’s chocolate syrup, only to find a dead rat inside the sealed bottle. The order, placed via Zepto, sparked immediate public outrage. While Hershey’s denied a manufacturing fault and pointed to the retailer, both brands suffered a reputational blow.

This wasn’t an isolated incident. Blinkit also came under scrutiny for hygiene lapses, with the Maharashtra FDA temporarily shutting down its Pune warehouse over safety violations.

The consumer demand for 10-minute deliveries is increasing, and so is the pressure on platforms and brands to ensure safety, compliance, and reliability at breakneck speeds. In this article, we explore the five biggest quick commerce challenges in India today, and what you can do to navigate them effectively.

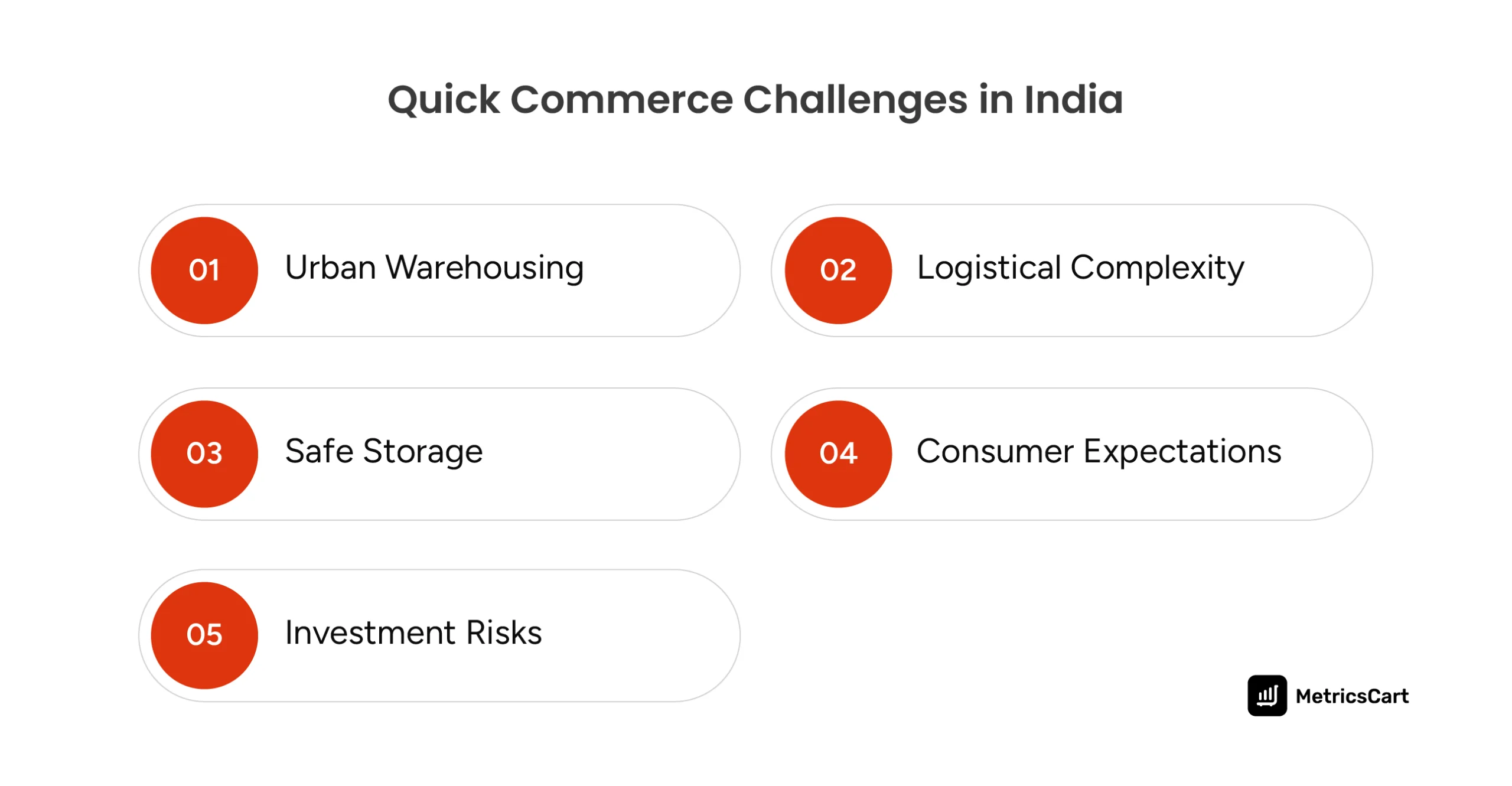

Navigating the Top 5 Quick Commerce Challenges in India

Quick commerce is growing fast. The market is projected to grow to $11.08 billion by 2030, Statista reports. But the growth comes at a cost. Here are the top 5 quick commerce challenges in India you must know before getting into the business:

1. The Pressure of Urban Warehousing

Quick commerce is built on proximity. To meet the 10-minute delivery promise, you need warehouses that are within a 2–3 km radius of the customer.

But setting up dark stores in prime urban pockets is expensive. Rental rates in cities like Mumbai and Bengaluru are rising faster than fulfillment SLAs. Add to that the rising energy bills and staffing costs; your margins start shrinking before the first order even comes in.

So how do you meet the growing demand within budget?

It’s not about having a massive, fully stocked warehouse. But a smart store with only what the customer actually needs.

So, track SKU velocity at the store level, not the city level. Then use this micro-ZIP demand intelligence to stock only what moves. And wherever possible, partner with multi-brand fulfillment networks that already have the infrastructure and last-mile visibility. It’ll help you expand coverage on time, at a lighter cost.

2. Logistical Complexity

Quick commerce in India is the most successful, largely due to its high population density, which provides cheap last-mile labor. However, this density introduces significant logistical complexity, including tight lanes, congested roads, incomplete addresses, unpredictable weather, and an overloaded last-mile workforce.

You can’t throw more delivery agents at the problem. That only adds cost and more chaos. The only way forward is operational efficiency. So batch deliveries and optimize routes. Additionally, design store coverage areas that align with your SKU mix and order volume.

To succeed in quick commerce, you must design smarter fulfillment paths where speed is an outcome, not an input.

3. Safety, Storage, and Disposal of Sensitive Goods

Q-commerce features high-risk categories such as perishables, cosmetics, OTC drugs, and household chemicals. Each comes with specific storage needs, temperature thresholds, and expiry mandates.

But many dark stores are not equipped for this. Items get stored in open racks. Expired stock isn’t tracked. Disposal processes are inconsistent. When issues arise, like in the Zepto-Hershey’s case, the blame springs between the brand and the platform, and the damage stays with both.

Brands need better control over batch tracking, shelf-life monitoring, and last-mile handoffs. To do that:

- Integrate expiry, batch, and compliance tracking into your warehouse monitoring system.

- Train warehouse staff on FSSAI and CDSCO compliance.

- Work with licensed vendors for waste disposal.

- Run mock recalls every quarter, especially for ingestibles.

4. Quick Commerce Investment Risks

Foreign investment in India’s e-commerce sector comes with a sharp legal line:

- 100% FDI is allowed in the marketplace model (where the platform connects buyers and sellers),

- FDI is prohibited in the inventory-based model (where the platform owns and sells inventory directly).

Quick commerce platforms, however, often blur this line. Most operate dark stores, manage their own inventory, and sell under a unified platform interface, giving consumers no visibility or choice of seller. This structure, while efficient for 10-minute deliveries, risks being classified as inventory-led.

This poses a problem, potentially violating FEMA regulations. That is, if a foreign-funded platform is found to be inventory-led in substance, it could face penalties under Section 13 of FEMA, 1999, including financial fines and prosecution risks for management.

To tackle this, make sure your platform is clearly structured as a marketplace. That means showing visible third-party sellers, issuing transparent invoices, and keeping seller onboarding clean.

Also, avoid holding inventory directly. Instead, work with local seller-partners or franchise-based models that stay within legal limits. Additionally, you can also get a thorough compliance check done by experts in FDI and FEMA before taking any foreign investment.

5. Meeting Consumer Expectations

Customer retention on quick commerce platforms is low. A study by Bain & Company reported that more than 60% of Indian users frequently switch between platforms based on price, availability, and delivery experience. This requires brands to maintain consistency not only in product quality but also in presentation, packaging, and fulfillment across each platform.

So ensure your listings are accurate, monitor how products appear in real-time, and track consumer feedback within platform reviews. Delays in addressing these areas can lead to reputational damage and lost sales.

READ MORE | Swiggy Instamart Price Tracker: Monitor Prices, Discounts & Stock Instantly

Future of Quick Commerce

Large FMCG brands in India have already entered into the quick commerce business, signaling a shift in how the channel is prioritized.

Hindustan Unilever, ITC, and Dabur are developing platform-specific SKUs and campaigns in partnership with Blinkit, Swiggy Instamart, and Zepto. Nestlé is promoting gifting packs and limited-edition items designed for rapid delivery, targeting impulse purchases and festive demand.

When it comes to platforms, Amazon Fresh is testing ultra-fast grocery delivery in major metropolitan areas. Reliance’s JioMart is integrating faster fulfillment through its retail network. Even Flipkart has launched pilot projects in the express delivery space.

This shift is particularly challenging for small and medium brands. To survive, smaller brands must narrow their focus and target a specific niche. Launching 2–3 core SKUs in high-demand cities, tracking daily performance using external tools, and scaling only on clear signals is key.

Remember, competing with large players requires not scale, but precision and discipline.

Final Note

While this sums up the quick commerce challenges in India for now, the risks of quick commerce are only going to grow.

More brands are entering. Platforms are tightening control. Consumer expectations are rising by the day. What used to be an early-mover advantage is now a daily operational challenge. And most of the time, you don’t even know what changed until sales drop or reviews pile up.

To keep pace, you need real-time visibility. Not just into your sales, but into the actual shelf your products live on. That’s where the MetricsCart quick commerce dashboard comes in.

It gives you live, actionable insights into pricing, discounts, availability, and brand performance across Blinkit, Zepto, and Swiggy Instamart, so you can:

- Catch competitor pricing and discount shifts before they impact your sales

- Pinpoint city-level stockouts and fix them before search rank tanks

- See which SKUs are dominating your category and why

- Benchmark your performance across price tiers, brands, and zones

- Fine-tune promos based on what’s working in your category today, and more.

Quick commerce moves in minutes. MetricsCart keeps you informed by the hour.

Want To Win Over Quick Commerce Shoppers? Book Your Free Demo Now.

FAQs

The top challenges include high urban warehousing costs, complex last-mile logistics, handling of sensitive goods like perishables and OTC drugs, rising consumer expectations, increasing platform control, and investment risks for smaller brands. Each of these demands real-time tracking and hyperlocal optimization to stay competitive.

India’s population density, affordable last-mile labor, and smartphone penetration make 10-minute delivery models feasible.

Sustainability of quick commerce depends on improving unit economics, ensuring compliance, and building brand trust. Without operational efficiency and real-time visibility into performance, quick commerce can become an expensive, high-churn channel for many brands.

Critics highlight environmental impact, labor exploitation, excessive packaging, safety concerns, and unhealthy consumer behavior driven by instant gratification. The Zepto-Hershey’s incident is a recent example of how safety lapses can trigger major brand and platform fallout.

To reduce risks, brands must invest in:

1. Micro-market demand intelligence

2. Real-time SKU tracking across platforms

3. Accurate and compliant product listings

4. Promo benchmarking and discount optimization

5. Stronger platform collaboration

Tools like MetricsCart help brands track performance across Blinkit, Zepto, and Instamart, so they can catch issues early and stay shelf-ready at all times.