The chewing gum category, long treated as a low-involvement impulse buy, is now evolving into a data-rich reflection of changing consumer priorities. Shoppers are no longer picking up gum as an afterthought at checkout aisles. They are comparing ingredients, scanning reviews, and choosing products that align with the latest wellness trends, such as sugar-free formulations and clean labels. And as visibility has moved from impulse aisles to online storefronts, consumers are evaluating options more easily and intentionally. In this article, we’ll explore the latest chewing gum trends with MetricsCart to understand what’s fueling this shift and how brands can stay competitive in a category no longer ruled by impulse.

Chewing Gum Trends with MetricsCart: An Overview

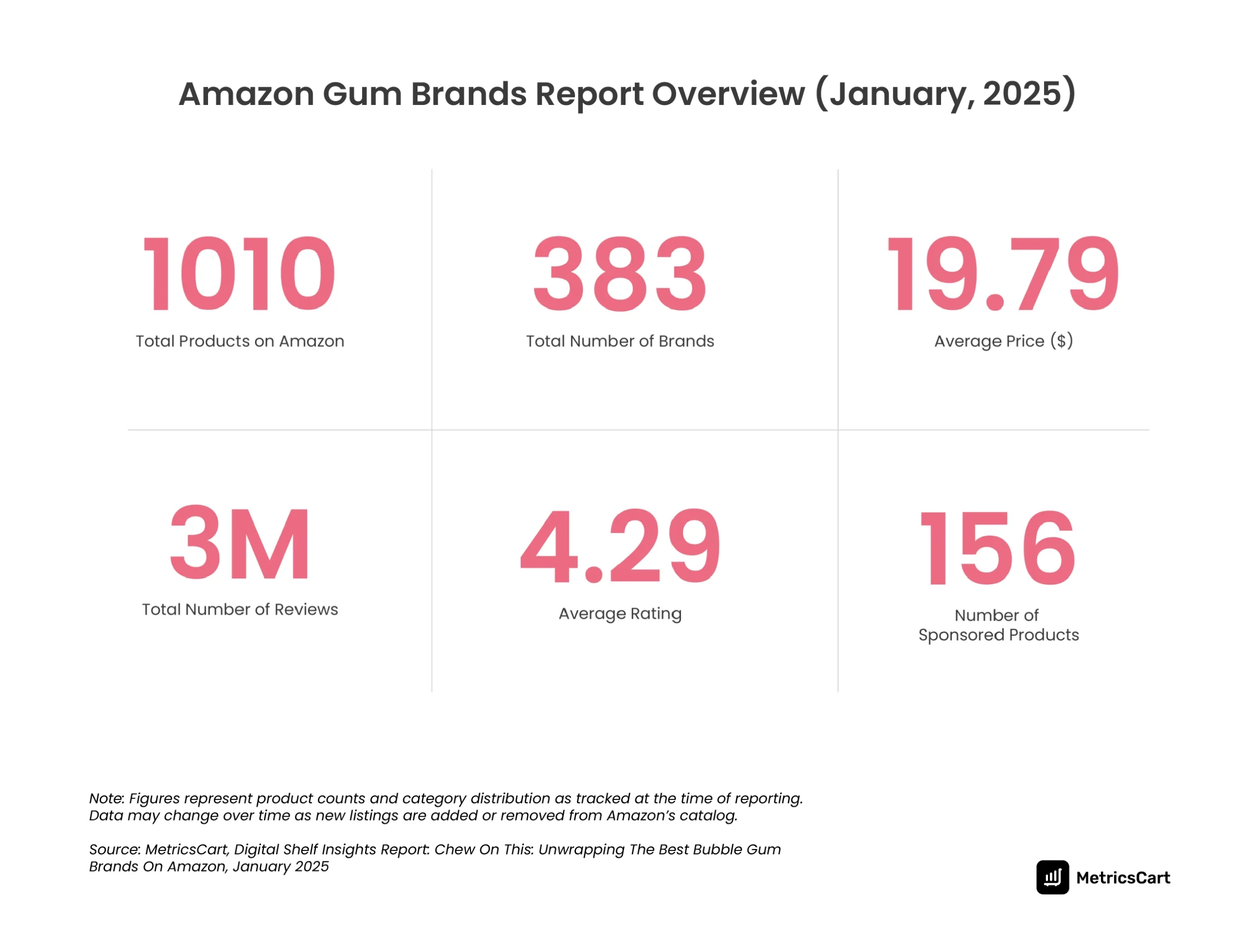

The chewing gum market is undergoing a significant transformation. Once dominated by classic flavors and heavy point-of-sale marketing, the category is now shaped by consumer awareness and online behavior. MetricsCart’s analysis of over 1,000 products across 380+ brands reveals three key dynamics driving this change:

The chewing gum market is undergoing a significant transformation. Once dominated by classic flavors and heavy point-of-sale marketing, the category is now shaped by consumer awareness and online behavior. MetricsCart’s analysis of over 1,000 products across 380+ brands reveals three key dynamics driving this change:

Health and Functional Benefits Take Center Stage

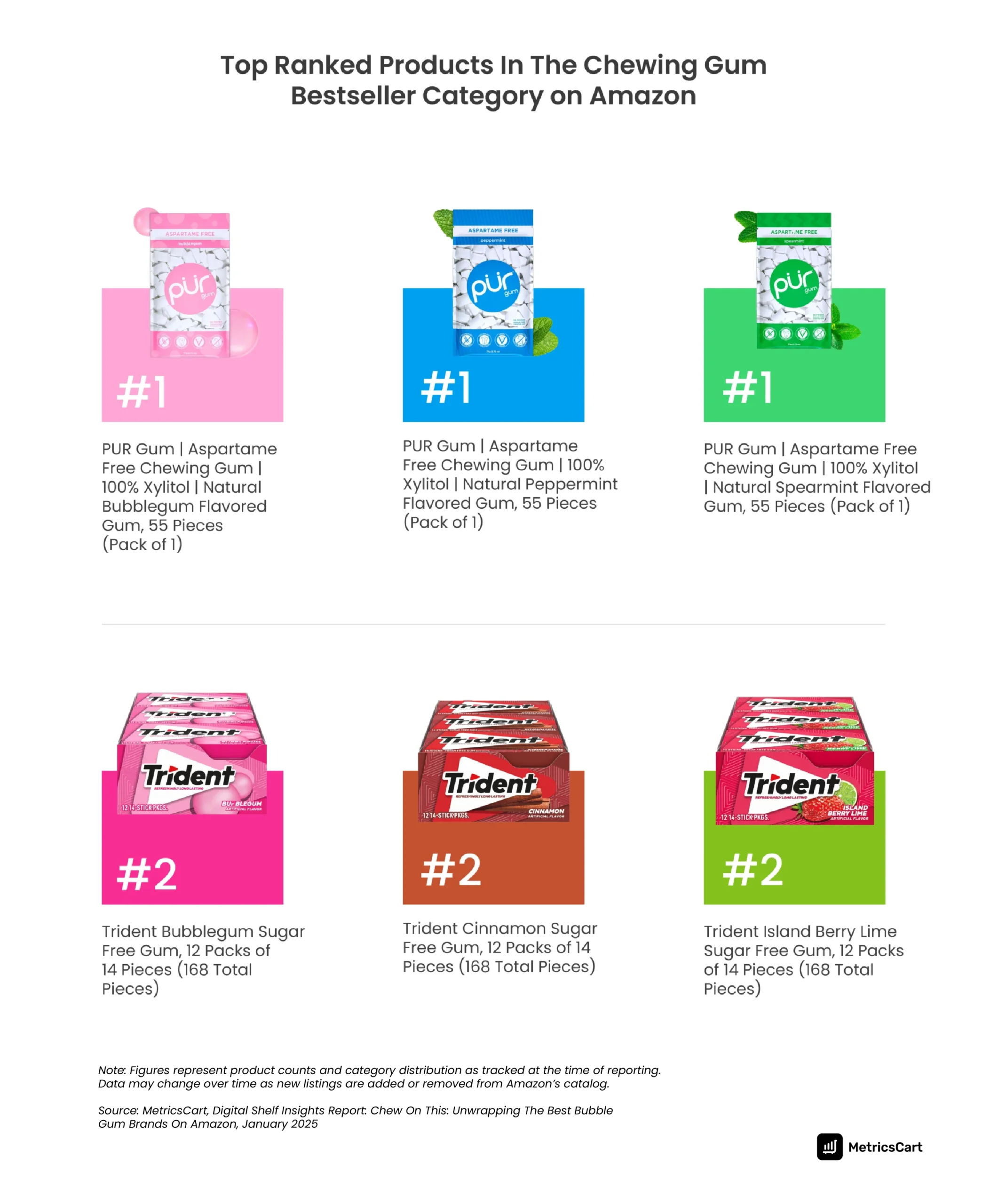

Sugar-free and functional gums are experiencing substantial growth. The global sugar-free chewing gum market is projected to reach $10.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.98% from 2025 to 2035. Similarly, the functional chewing gum market is expected to grow from $16.7 billion in 2025 to $42.6 billion by 2035, with a CAGR of 9.8%. In addition, MetricsCart analytics has spotted a major shift towards sugar-free gums with xylitol. Consumers are prioritizing clean labels and looking for alternatives that don’t compromise oral health. And the top-ranked and reviewed products are sugar-free and xylitol-based PUR Gum and Trident Original Flavor Sugar Free Gum. This growth is driven by increasing consumer demand for products that offer benefits beyond basic taste, such as improved oral health, stress relief, and energy boosts.

Digital Visibility Alone Does Not Determine Purchase Decisions

Today, most shoppers make their decisions online. A strong product page and steady promotion directly help with more clicks and repeat buyers. MetricsCart data shows that Orbit is the most active advertiser on Amazon with 7 sponsored listings. But it still does not rank high in organic results. PUR and Trident perform better here. PUR has the highest number of reviews at 402.4k, and Trident has the most US-origin SKUs listed. This shows that targeted paid ads can bring visitors to a product page. But good reviews, clear information, and trust from real shoppers are what drive actual sales.

Flavor and Experience Still Matter, But Differently

While classic mint and fruit flavors remain popular, consumers are increasingly seeking innovative flavors and textures. Brands offering unique experiences, such as limited editions or functional benefits like stress relief or energy boosts, are seeing higher engagement. This trend is particularly evident in e-commerce settings, where discovery is easier than in physical stores. Together, these insights show that the chewing gum market has become a competitive landscape where data-driven strategies and consumer-first messaging win.

READ MORE | Chew On This: Unwrapping The Best Bubble Gum Brands On Amazon

Which Chewing Gum Do Americans Prefer the Most?

The MetricsCart review analysis of chewing gum trends reveals Americans’ increasing preference for clean-label, sugar-free gum, which could be perceived as healthy.  Among over 1,000 products across 383 brands on Amazon, PUR Gum stands out with the most reviews, over 402,000, far surpassing legendary competitors like Trident, Orbit, and Extra. PUR’s biggest advantage is its clean-label positioning:

Among over 1,000 products across 383 brands on Amazon, PUR Gum stands out with the most reviews, over 402,000, far surpassing legendary competitors like Trident, Orbit, and Extra. PUR’s biggest advantage is its clean-label positioning:

- Sugar-free and aspartame-free

- Gluten-free, nut-free, and soy-free

- Vegan

- Sweetened with xylitol

This combination makes PUR an easy yes for health-conscious shoppers, parents buying for kids, and anyone with dietary or ingredient restrictions. The brand does not need to over-claim health benefits as the ingredient list itself builds credibility. Also, when we look at flavor preference, mint still dominates, followed by spearmint and peppermint variations. The top-ranked SKUs of PUR stick to this tried-and-true mints and avoid gimmicky “berry fusion”, which consumers are still reluctant to try.

Changing Consumer Behavior and Category Dynamics in the Chewing Gum Market

The chewing gum analytics with MetricsCart show that the category is defined less by flavor and more by SKU strategy, price tiering, engagement, and innovative formats now. Brands that can optimize across these dimensions are the ones poised to lead in this increasingly competitive and data-driven category.

Functional Gum Is Turning Into A Micro-Wellness Product

Gum is slowly moving into the same territory as energy drinks, sleep aids, and nootropics. Instead of selling “fresh breath,” brands are now selling a micro-benefit you can take on the go. Functional gums are positioned as faster, cleaner, and more convenient than pills, drinks, or sprays. What used to be a novelty is now a legitimate product segment that consumers actively search for online.

Pack Size And Packaging Are New Trust Signals

Historically, gum was dominated by single-serve or small pocket packs. Online shoppers, however, are leaning toward canisters, bulk refills, multi-packs, or travel formats since these feel more practical for desks, cars, or family use. At the same time, packaging itself is also becoming a credibility check. Eco-conscious shoppers evaluate:

- Whether the packaging is recyclable

- Whether refills reduce plastic waste

- Whether brands publicly reference sourcing transparency

This mirrors broader FMCG behavior: consumers treat packaging as a trust signal, not an afterthought. What used to be a small design detail is now a cue about how responsible and consumer-friendly the brand is.

Younger Buyers Are Not Impulse Buyers

The biggest shift in the gum category is coming from Gen Z. This consumer group does not treat gum as a small flavor fix. They treat it as a lifestyle product that should offer some form of personal benefit, and for that, they evaluate gum with the same lens they use for skincare and supplements. They read labels, search ingredients, and compare claims before purchasing, looking for brands that signal clean formulation and real function. For Gen Z, sugar-free is no longer a premium claim. It is expected. What moves them instead is a purpose-driven benefit. A gum that supports focus during work, induces calm during stress, or provides oral care after a meal is more appealing than one that only delivers flavor. This is why functional gum is seeing stronger traction online than traditional brands that rely on habit and shelf placement. Gen Z also buys through proof, not advertising. They look for validation in Amazon reviews, honest TikTok breakdowns, and Reddit threads where people describe what the gum actually did for them. Discovery happens long before the shopper reaches a product page. By the time they add to the cart, a belief has already formed around the outcome they expect.

READ MORE | Gen Z Marketing Strategies: How Brands Can Win the Next Generation of Consumers

How MetricsCart Helps Chewing Gum Brands Grow

As chewing gum evolves from a candy item into a wellness product, brands can no longer rely on shelf placement or broad advertising to drive demand. Growth now depends on how well a brand understands what shoppers value, how they evaluate trust, and why they repurchase, and that is where a Digital Shelf Analytics tool like MetricsCart becomes useful.

Actionable Insights for Product, Marketing, and CX Teams

Different teams inside a gum brand need different signals from the market. Product teams want to know which formulations and functions are gaining traction. Marketing teams need clarity on which claims actually influence conversion. CX teams need to understand whether customers are buying repeatedly or dropping off after the first try. MetricsCart brings these signals together in one view so decisions are based on shopper behavior, not assumptions.

Turning UGC and Reviews into Product Intelligence

Your customers are already telling you what to fix and what to double down on. The challenge is not the lack of feedback. It is the volume. With thousands of Amazon reviews, TikTok taste tests, YouTube breakdowns, and Reddit comparisons, it becomes impossible to manually identify which pieces of feedback actually matter. MetricsCart solves this by turning all that noise into readable product intelligence. Its UGC and voice-of-customer tracking system pulls reviews and community feedback from multiple platforms and turns them into structured intelligence. Instead of scanning comments one by one, you see what customers repeatedly value, what they question, and what makes them hesitate to repurchase. This level of clarity helps a brand make better product decisions. If customers praise texture but complain about aftertaste, you know which attribute needs refinement. If they consistently mention “helps me stay focused” or “calmer during work,” that becomes a message worth elevating in your PDP copy.

Strengthening Your PDP Before Shoppers Drop Off

Drop-offs usually happen not because the product is bad, but because the value is not immediately clear. MetricsCart helps you fix that before it turns into lost conversions. With insights across Share of Search, Content Compliance, Ratings & Reviews, and competitor performance, MetricsCart shows exactly how your PDP stacks up in visibility, engagement, and conversion performance. You’ll see where shoppers lose interest, whether it’s missing keywords, weak visuals, inconsistent pricing, or negative sentiment quietly influencing behavior. By addressing those friction points, you can turn your PDP from a static listing into a conversion engine. Learn the seven most-effective strategies that have helped global brands make it big on the digital shelf. Download the free e-book.

The Last Pop

The evolution of gum is heading toward measurable wellness outcomes and transparent sourcing. Future leaders in this space will invest not just in R&D but also in real-time consumer intelligence to identify unmet needs and build formulations that deliver specific functional benefits that stand out at the point of consideration. Instead of relying on gut instinct, brands can use digital shelf analytics tools like MetricsCart to extract live marketplace data. It enables them to understand which claims convert, which pack formats signal value, and how sustainability cues and ingredient transparency affect purchase intent. As digital shelf algorithms continue to reward credibility and relevance, chewing gum will move decisively from impulse to intention, something more functional, more traceable, and shaped by what shoppers signal in real time rather than what sits near the checkout counter.

Track Trends As They Happen with MetricsCart.

FAQs

Chewing gum used to rely on checkout visibility and habit. Today, shoppers are comparing ingredients, reading reviews, and choosing products that align with wellness goals like sugar-free, clean-label, or functional benefits. This makes gum a considered purchase rather than a quick grab.

The top three trends are:

1. Growth in sugar-free and functional formulations

2. Ingredient transparency and clean labeling

3. Packaging and format acting as trust signals (bulk, refill, canister, eco-friendly)

MetricsCart chewing gum trend analysis shows PUR Gum is the best-performing brand on Amazon. It is leading Amazon in review volume and engagement, largely due to its clean-label positioning and allergen-free formulation. Shoppers see the ingredient list as a proof point, not just marketing.

MetricsCart helps brands identify which claims convert, which pack formats perform best, and what shoppers repeatedly praise or criticize. Instead of guessing, brands can act on real-time marketplace signals drawn from Amazon reviews, UGC, and search behavior.

Most purchase intent is formed before shoppers reach the product page. Reviews and social feedback reveal what customers actually value and what prevents repeat purchases. Without tracking this data, brands react too late.