Online marketplaces offer small to medium-sized businesses a wonderful opportunity to build a digital storefront. In 2024, the annual e-commerce sales of the top two US marketplaces, Amazon and Walmart, are set to reach $408.19 billion and $71.93 billion, respectively.

Walmart’s competition with Amazon is like the cola war between Coke and Pepsi. There could be a lot of questions in the minds of third-party (3P) sellers who have to make a choice between Walmart vs. Amazon.

Here, we have attempted to find answers to a few common questions related to the two big marketplaces that might cross the minds of new sellers.

Amazon vs. Walmart Competitive Analysis: What Do Customers Prefer?

Ideally, customers prefer to shop at a one-stop marketplace that provides groceries, general merchandise, and quality items from third-party sellers at the best price.

In 2023, market research data by Capital One revealed customers in the US spent 486% more on Amazon than they spent at Walmart. Amazon makes more sales than Walmart.

- Better price was the reason cited by 22% of customers

- 30% preferred Amazon for the variety of products available in stock

- 30% said they like the ease of delivery by Amazon

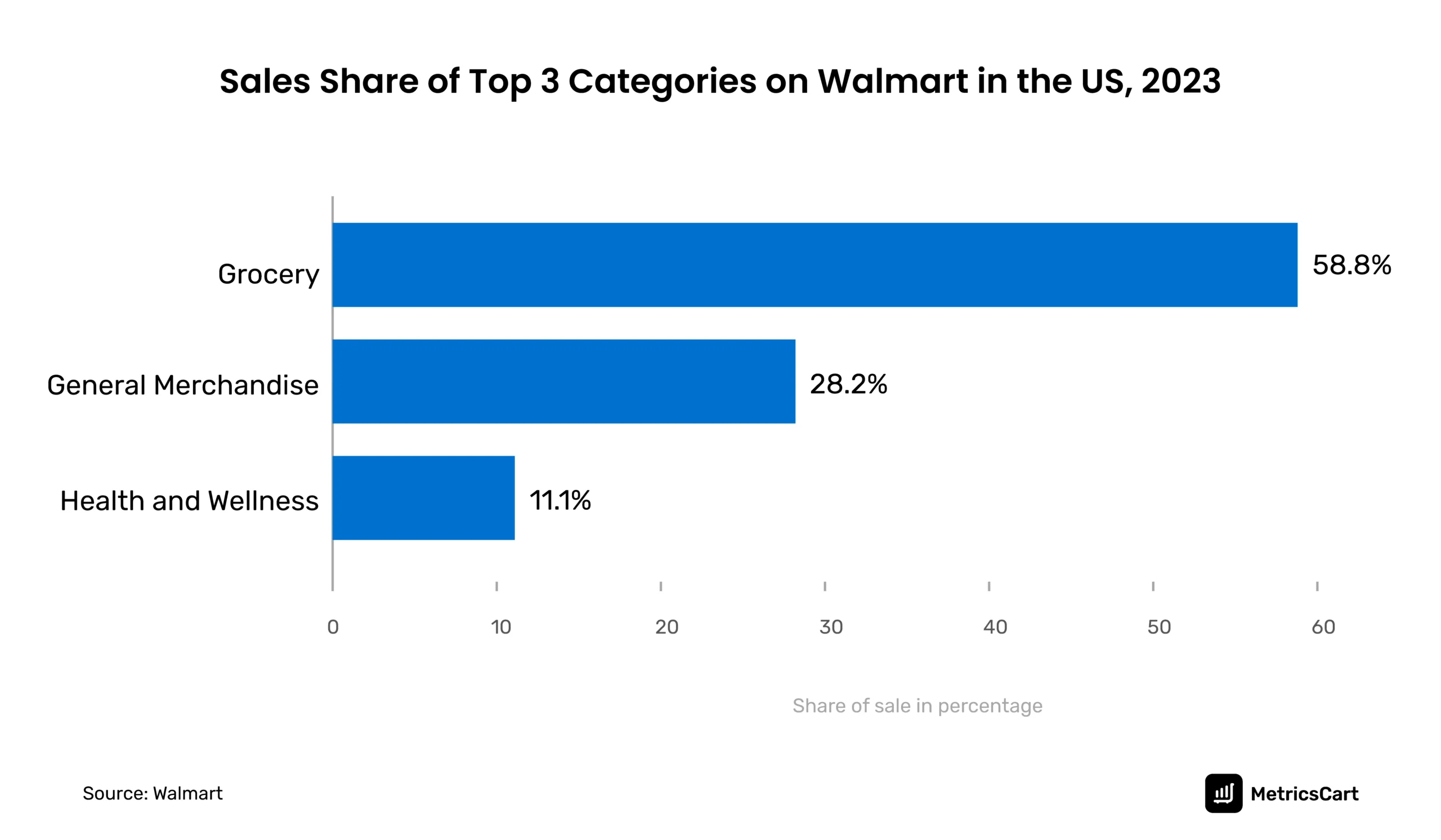

Despite offering 2-hour grocery delivery across 2000 cities, Walmart beats Amazon hands down in the grocery segment with an 18% market share. Although Amazon bought Whole Foods in 2017, they comprise as little as 1.5% market share in the grocery segment.

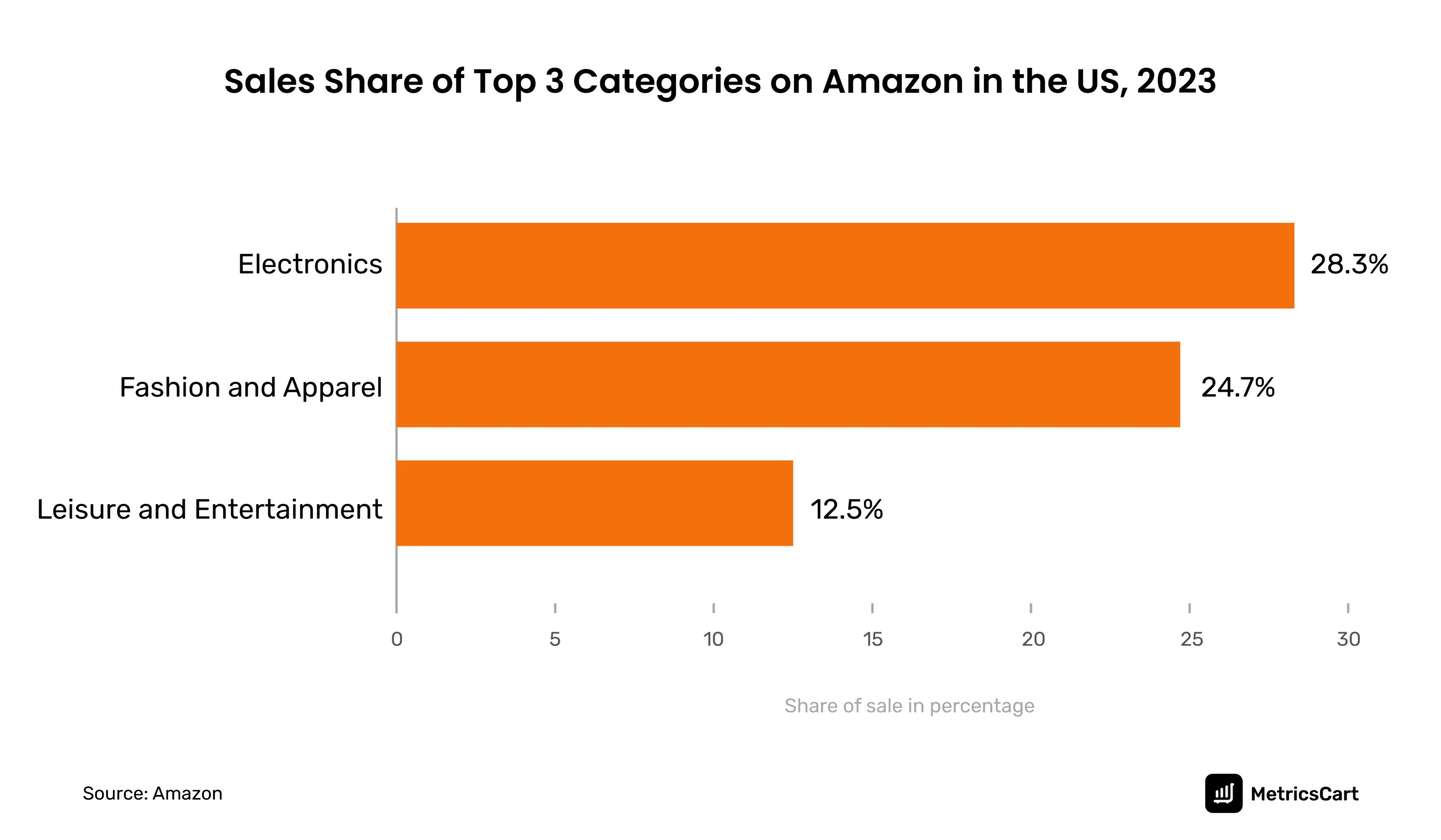

Grocery is usually sourced by the marketplaces from various local suppliers (1P sellers). Among the categories sold by 3P sellers, electronics is Amazon’s most popular product category, followed by items related to fashion, and the third share belongs to leisure items.

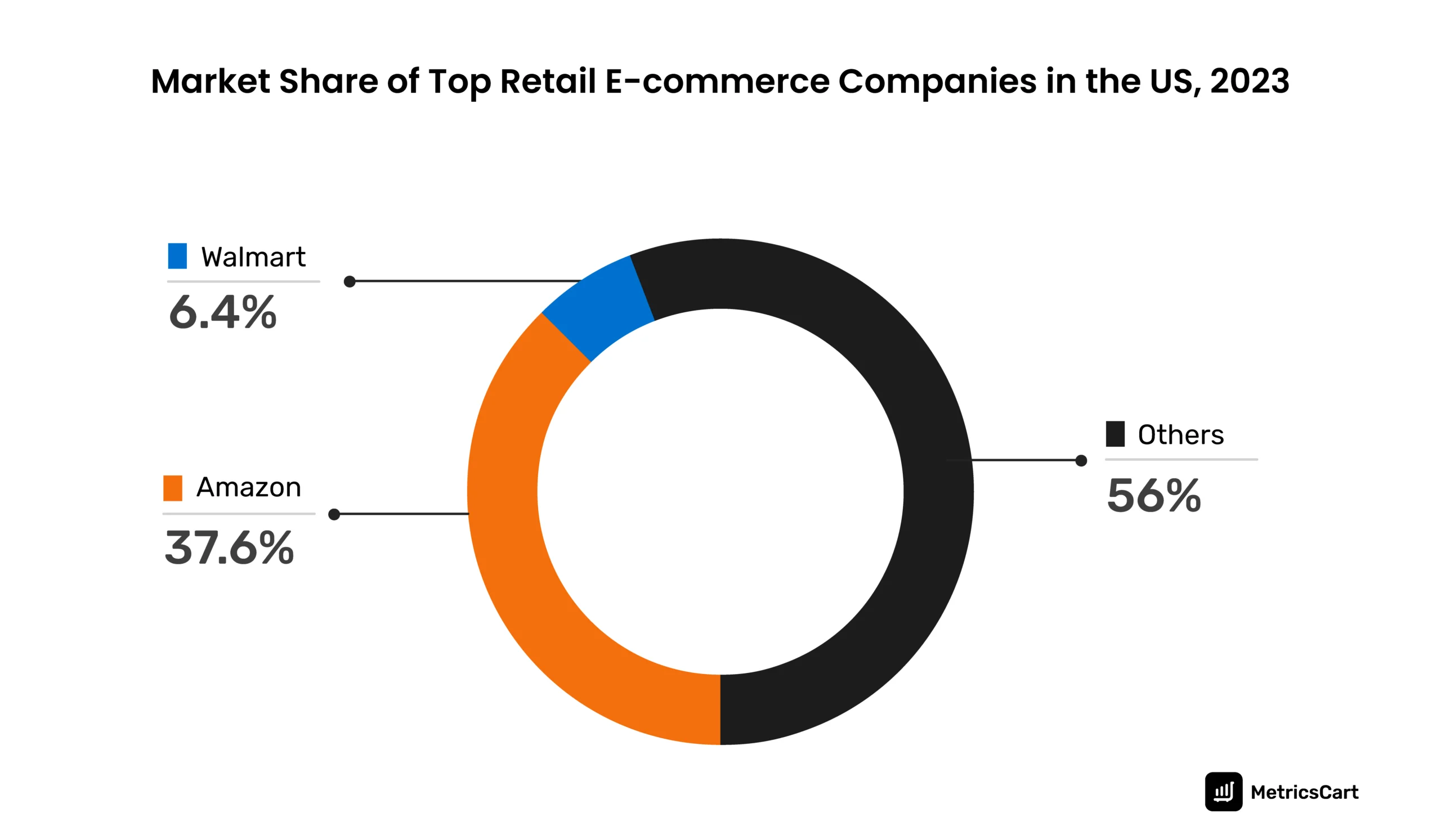

Against the 28.3% market share enjoyed by Amazon, Walmart holds just a 6.2% share of the pie. E-commerce shoppers generally compare various marketplaces before the final purchase. In this case, a new seller entering the electronics segment may have a better chance to rank on Walmart if similar products and brands are sold competitively. On the other hand, to be visible on the search result page of Amazon, sellers may have to spend on paid ads.

There is a group of customers who are loyal to Walmart.

- 41% of consumers like to shop at Walmart for the low prices

- Walmart is capable of delivering fresh produce to households at the earliest through its 5358 retail units that double up as fulfillment centers

- 29% appreciate the return policy as they have the option to return items at any of the Walmart stores in the US

READ MORE | How different is it for first-party and third-party sellers on Amazon? Read our detailed guide on Amazon 1P vs. 3P: Choosing the Right Selling Model

Onboarding: Walmart vs. Amazon

A 3P seller on Amazon or Walmart gets a certain level of independence to control prices and manage listings, advertisements, and sales via Amazon’s Seller Central or Walmart’s Seller Center account portals.

For sellers selling unique, innovative products, Amazon has designed a program called ‘Launchpad.’ The intent is to help sellers reach out to customers exclusively through Amazon.

- Interested sellers should register, create an account page on Amazon’s Seller Central, choose the fulfillment option, and complete the form.

- Sellers should have a business address to where Amazon may send a postcard to verify.

- Once verified, the seller can begin uploading product details of items to sell online.

Walmart has joined hands with RangeMe to gather product pitches from US entrepreneurs. As consumers love to get same-day delivery, US sellers can apply to the ‘Open Call’ category to qualify for delivering the goods to customers within 24 hours and be visible on shelves in physical stores. The criteria is that the products must be made, grown, or assembled in the US.

- Walmart takes around 1-2 months to approve new sellers

- They require sellers to list 5-10 sample products to assess their product quality, order accuracy potential, and seller stability

- All items must have UPC (sellers have to purchase them or obtain exemptions in case of unbranded products)

Commonalities

To win the buy box and increase the probability of sales on a massive marketplace such as Amazon or Walmart, sellers need

- A well-thought-out marketing strategy

- Create optimized listings

- Do a competitive market analysis before deciding on a selling price

- Provide customers with a fine shopping experience

Fees

The fee associated with Amazon depends on the product type and the fulfillment option. All sellers have to pay:

- A subscription fee: A professional seller subscription costs $39.99 a month

- Referral fees: Depending on the product, sellers have to pay 6 – 45% of the final price

- Closing fees: Books and DVDs are charged a flat fee of $1.80

- Processing fees: In case of refund, $5.00 or 20% of an item’s sale price is levied

Additionally, sellers that sign up for FBA services have to pay:

- Fulfillment fees: Cost depends on the weight and size of each product

- Returns fees: A weight-based fee is levied for each item returned to Amazon

- Monthly storage fees: $2.40 per cubic foot

- Long-term storage fees: $6.90 per cubic foot for long-stored excess inventory

When weighing the seller fees of Walmart versus Amazon, Walmart is a low-cost option as they do not charge subscription and processing fees.

- Referral fees: Sellers pay between 6% and 20% on each sale, depending on the type of product sold

Sellers who sign up for Walmart Fulfillment Services pay:

- Fulfillment fees: Cost depends on the weight and size of the item

- Monthly storage fees: 75c per cubic foot for less than a month and an extra fee of $1.50 if stored for over 30 days

- Long-term storage fees: $7.50 per cubic foot for unsold goods over a year

Performance

Once the products are listed on Walmart Marketplace, sellers are judged on three factors:

- The order defect rate (ODR) should be less than 2% in a time period of 90 days

- The sellers should deliver on-time shipments 99% of the time

- The valid tracking rate should be 99%

Amazon tracks three seller performance metrics:

- In a 2-month period, negative feedback, claims under the company’s A-to-z guarantee, and credit card chargebacks should be maintained under 1%

- In a week, seller-cancelled orders should be maintained below 2.5%

- If the seller fulfills the shipment, the late shipment rate should be below 4% over a 10-day period

Consistent failures to meet the above requirements can lead to warnings followed by account suspension on Walmart and on Amazon, and sellers may lose the buy box.

How to Rank on Walmart vs. Amazon?

The account portals of both Walmart and Amazon give a detailed account of how sellers can optimize listings on their marketplaces.

The marketplace data available with Amazon is huge. They scan through the data of all the listings:

- To display the most appropriate products to the customers

- The company uses the insights to identify gaps, introduce new products, and make pricing decisions for its private-label products

Given this scenario, sellers selling their products on multiple marketplaces need to use the services of external product monitoring service providers such as MetricsCart to get a holistic view of the product portfolio of sellers and brands.

Competitor Price Monitoring

As per Capital One Shopping Research, in May 2024, Amazon had around 12 million privately labeled items on sale and over 350 million items listed by 3P sellers. It is challenging for sellers as they have to beat competition from fellow sellers and Amazon’s brands.

Amazon’s algorithm analyzes customers’ search queries and selects the most relevant brand offers with positive reviews, reasonable pricing, FBA shipment, and optimized listing. To be true to its EDLP policy, Walmart unpublishes listings that it feels are unfairly priced.

MetricsCart’s price monitoring service can help sellers track competitor pricing in these cases.

Monitor MAP Policy Adherence

When the size of the marketplace grows, policing the platform becomes difficult. It is often difficult to keep track of unauthorized sellers. If the resellers are selling brands having a strong MAP policy in place, they have to be careful not to violate it by advertising at a lower price to attract customers.

To avoid losses, sellers can raise complaints if they spot MAP violators or sellers selling counterfeit goods or expired items.

Optimize Listing

An increasing use of voice search in e-commerce highlights the need for optimized content. SEO-optimized catalogs with high-quality images and videos and well-described product features can help rank high on organic search result pages.

Keeping track of the catalogs through the MetricsCart content scorecard can help sellers take action on time and never lose on sales.

Track Bestsellers

Knowing the bestsellers in various online shopping categories is a good way to stay relevant by keeping up with the top trends and consumer choices. These insights can help sellers and brands decide on product range expansion.

Tips to Improve Category Ranking on Amazon

- An optimized listing wins the Buy Box and appears in the voice search

- List the product in the appropriate category to organically rank in the search results

- Avoid running out of stock and ensure timely fulfillment of orders to avoid penalties

- Increase sales velocity through sponsored products

Tips to Win a Pro-Seller Badge on Walmart

- Avoid keyword stuffing

- Follow Walmart’s image requirements

- Have many product variants to meet the search intent of a larger number of shoppers

- Use the title formula: brand + item name + model + key attribute + pack count + size

It is always better to diversify risk by selling products on multiple marketplaces. Consistent failures to meet the above requirements can lead to warnings followed by account suspension on Walmart, whereas there is a fear of losing the buy box on Amazon.

READ MORE | Want to Get a Historical View on Black Friday Sales in the US? Scan through Black Friday Sales 2021: Walmart versus Amazon.

Pros and Cons of Selling on Amazon vs Walmart

Amazon is a mature e-commerce market with almost 1.1 million US sellers listed on their marketplace, catering to most online shoppers in the US. And Walmart is emerging as a serious challenger to Amazon in e-commerce.

Listed below are the differences between the two marketplaces.

| Features of Marketplace | Amazon | Walmart |

| Online Market Share | 37.6% | 6.4% |

| Onboarding Time | Onboarding is relatively quick for a 3P seller | Onboarding takes at least 3 weeks |

| Fees | Standard fee Monthly subscription Referral feeHas Seller support fee Fulfillment fee & Storage fee |

Standard fee No subscription fee Referral feeNo seller support fee Fulfillment fee & Storage fee |

| Loyalty membership | Prime members get 1-2 days delivery free on millions of products | Walmart+ membership provides enhanced omnichannel shopping benefits |

| Fulfillment Centers | In 90 metropolitan areas in the US, the company has same-day facilities closer to major population centers | 5358 stores in the US that double as fulfillment centers or pickup locations |

| Number of visits | 2 billion visits/ month | 389 million visits/ month |

| Advertisements | Advertising is almost saturated

The highest bidder pays the most to advertise the product |

1.6% of sellers currently choose among Sponsored Search ads

Flash Picks The highest bidder selling a product popular on search queries is given weightage |

Selling on Amazon is demanding as the company frequently updates the rules and policies for various product categories. The competition on the platform is stiff.

Yet, for international brands and sellers selling bulky items, Amazon and its FBA services beat Walmart. Currently, WFS accepts shipments to its fulfillment centers solely from the US. The maximum package weight Walmart allows is 30 pounds, which is much smaller than Amazon’s 150 pounds. This is a disadvantage for sellers who are considering selling bulky items through Walmart.

Final Note

To summarize, Amazon monetizes data with an AI engine to curate accurate product pitches for different customers. The company uses a highly effective selling strategy and functional technology.

On the other hand, Walmart is less saturated than Amazon for new entrants in the online business. However, a ‘copy and paste’ of Amazon’s selling strategy to Walmart may not drive profitable results in the long run.

Whichever marketplace you have decided to list on, give a MetricsCart representative a chance to discuss the features we can monitor and help you ace the e-commerce game at a competitive price. By providing digital shelf analytics, we have played a valuable part in the conversion funnel for many sellers who jumpstarted their journey into online selling. Now it is your turn!